Understanding Forex Trading Hours and Market Sessions

Forex (foreign exchange) trading is a global, decentralized market that operates 24 hours a day, five days a week. Unlike stock markets that have fixed trading hours, forex trading sessions overlap across different time zones, offering traders continuous opportunities to enter and exit trades. Understanding forex trading hours and market sessions is crucial for optimizing trading strategies and capitalizing on market movements.

Forex Market Sessions Overview

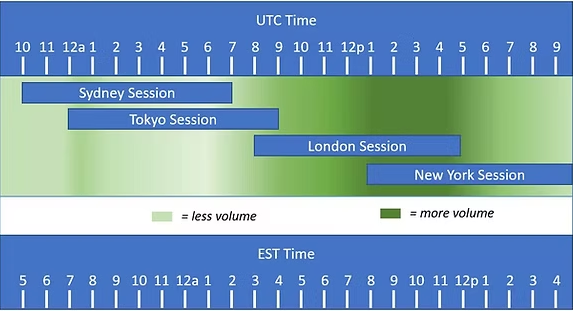

The forex market is divided into four major trading sessions based on global financial centers:

- Sydney Session (10 PM – 7 AM GMT)

- Tokyo Session (12 AM – 9 AM GMT)

- London Session (8 AM – 5 PM GMT)

- New York Session (1 PM – 10 PM GMT)

Each session represents the peak trading hours of a specific financial hub, and certain currency pairs exhibit higher volatility depending on the session.

Key Trading Sessions and Overlaps

1. Sydney Session

The Sydney session marks the beginning of the forex trading week on Monday morning in Australia. It is generally less volatile compared to other sessions but still provides opportunities for trading currency pairs involving the Australian dollar (AUD) and New Zealand dollar (NZD).

2. Tokyo Session

As the Asian markets open, liquidity and volatility increase, especially for currency pairs involving the Japanese yen (JPY). This session overlaps with the Sydney session for a brief period, leading to modest price movements.

3. London Session

The London session is the most active trading session, with the highest liquidity and volatility. Since many large financial institutions operate from London, major currency pairs such as EUR/USD, GBP/USD, and USD/CHF see significant price movements.

4. New York Session

The New York session begins as the London session continues, creating a highly volatile overlap. This period is particularly important for traders since the U.S. market contributes significantly to global forex trading volume. Major news releases from the U.S. can also cause significant price fluctuations.

Best Times to Trade Forex

The best times to trade forex depend on the trader’s strategy and the currency pairs they are trading. Generally, the most favorable trading periods are during session overlaps:

- London and New York Overlap (1 PM – 5 PM GMT): Highest trading volume and volatility.

- Tokyo and London Overlap (8 AM – 9 AM GMT): Moderate volatility, useful for trading Asian-European pairs.

- Tokyo and Sydney Overlap (12 AM – 2 AM GMT): Less volatile, ideal for low-risk strategies.

Factors Affecting Forex Trading Hours

- Market Holidays: Although forex is a global market, national holidays in major financial centers can reduce liquidity and impact volatility.

- Economic Events: News releases, interest rate decisions, and economic reports from key economies can cause significant price fluctuations.

- Daylight Saving Time (DST): Some market sessions shift slightly due to DST changes, particularly in the U.S. and Europe.

Conclusion

Understanding forex trading hours and market sessions is essential for any trader looking to maximize their profits and manage risks effectively. By identifying the best trading periods and recognizing key overlaps, traders can optimize their strategies for greater success in the forex market.

Whether you’re a beginner or an experienced trader, staying informed about market hours and global events can help you make better trading decisions and enhance your overall performance.