Top Forex Trading Strategies for Beginners

Forex trading can be an exciting and profitable endeavor, but it also comes with risks, especially for beginners. Having a solid trading strategy is crucial for success in the foreign exchange market. In this blog post, we’ll explore some of the best forex trading strategies that beginners can use to improve their chances of making consistent profits.

Here are Some of the Trading Strategies

1. Trend Following Strategy

One of the simplest and most effective strategies for beginners is trend following. This approach involves identifying the market trend—whether it’s an uptrend or a downtrend—and trading in the direction of that trend.

How to Implement:

- Use moving averages (e.g., 50-day and 200-day) to identify trends.

- Enter long positions in an uptrend and short positions in a downtrend.

- Use stop-loss orders to minimize risk.

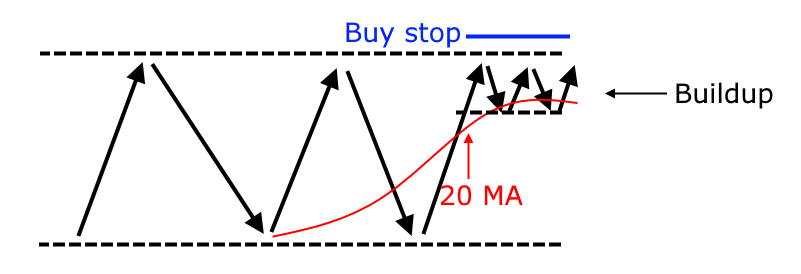

2. Breakout Trading Strategy

Breakout trading focuses on entering a trade when the price moves beyond a defined support or resistance level with increased volume. This strategy is ideal for beginners because it helps capture strong price movements.

How to Implement:

- Identify key support and resistance levels on the chart.

- Wait for the price to break through these levels.

- Confirm the breakout with increased trading volume.

- Place stop-loss orders just below (for buy trades) or above (for sell trades) the breakout level.

3. Support and Resistance Trading

Support and resistance levels are crucial in forex trading. These levels indicate areas where prices tend to reverse or stall. Trading based on support and resistance can be highly effective for beginners.

How to Implement:

- Identify key support (price floor) and resistance (price ceiling) levels.

- Buy near support and sell near resistance.

- Use confirmation signals like candlestick patterns or volume spikes before entering a trade.

4. Moving Average Crossover Strategy

A moving average crossover strategy involves using two different moving averages—one short-term and one long-term—to generate buy and sell signals.

How to Implement:

- Use a 50-day moving average and a 200-day moving average.

- When the short-term moving average crosses above the long-term moving average, it’s a buy signal.

- When the short-term moving average crosses below the long-term moving average, it’s a sell signal.

5. Scalping Strategy

Scalping is a short-term trading strategy where traders make multiple trades throughout the day to capture small price movements.

How to Implement:

- Use a low-spread forex broker for quick trades.

- Trade on lower timeframes (1-minute or 5-minute charts).

- Focus on high liquidity currency pairs (e.g., EUR/USD, GBP/USD).

- Use tight stop-loss and take-profit levels.

6. Risk Management Tips for Beginners

Regardless of the trading strategies you choose, risk management is essential in forex trading. Here are some risk management tips:

- Never risk more than 1-2% of your trading capital on a single trade.

- Always use stop-loss orders to protect your account from significant losses.

- Avoid overleveraging, as it can lead to significant losses.

- Keep a trading journal to track your progress and learn from your mistakes.

Conclusion

Forex trading strategies help beginners navigate the complex forex market with more confidence. Whether you choose trend following, breakout trading, or scalping, it’s important to practice these trading strategies in a demo account before trading with real money. With proper discipline and risk management, beginners can develop profitable trading habits and improve their long-term success.