How to Use Fibonacci Retracement in Forex Trading

Fibonacci retracement is a powerful tool used by forex traders to identify potential support and resistance levels. It is based on the Fibonacci sequence, a series of numbers with unique mathematical properties that frequently appear in nature and financial markets. By using Fibonacci retracement, traders can improve their market analysis and enhance their trading strategies. In this blog post, we’ll explore what Fibonacci retracement is, how to use it in forex trading, and key strategies to maximize its effectiveness.

Understanding Fibonacci Retracement in Forex

Fibonacci retracement is a technical analysis tool that helps traders identify potential price pullbacks within a trend. The key Fibonacci retracement levels are:

- 23.6%

- 38.2%

- 50% (not an official Fibonacci number, but commonly used)

- 61.8%

- 78.6%

These levels indicate possible points where the price may find support or resistance before continuing in the original trend direction.

How to Use Fibonacci Retracement in Forex Trading

1. Identify the Trend

Before applying Fibonacci retracement, determine whether the market is in an uptrend or downtrend. Fibonacci retracement works best when used within trending markets.

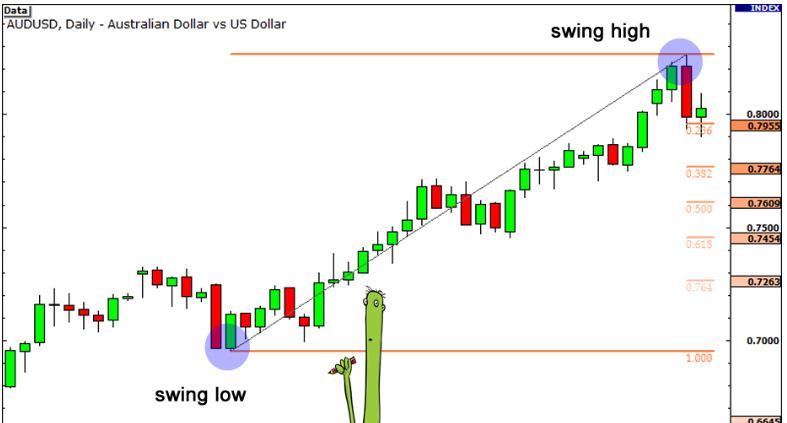

2. Draw Fibonacci Levels

To apply Fibonacci retracement:

- For an uptrend, select the most recent swing low and drag the tool to the most recent swing high.

- For a downtrend, select the most recent swing high and drag the tool to the most recent swing low.

This will generate Fibonacci retracement levels on your chart.

3. Look for Support and Resistance

The retracement levels act as potential support (in an uptrend) or resistance (in a downtrend). Traders often look for price reactions at these levels to make informed trading decisions.

4. Combine with Other Technical Indicators

Fibonacci retracement is most effective when combined with other technical tools, such as:

- Moving Averages: Confluence of Fibonacci levels and moving averages strengthens support/resistance zones.

- Trendlines: If a Fibonacci level aligns with a trendline, it adds validity to the price level.

- Candlestick Patterns: Reversal patterns near Fibonacci levels can signal potential trade entries.

- Relative Strength Index (RSI): Identifying overbought or oversold conditions near Fibonacci levels can confirm trade opportunities.

5. Set Entry and Exit Points in Retracement in Forex

- Entry: Traders often wait for price confirmation at a Fibonacci level before entering a trade.

- Stop-Loss: Placing a stop-loss just beyond the next Fibonacci level helps manage risk.

- Take-Profit: Setting profit targets at higher Fibonacci levels (such as 61.8% or 100%) allows traders to maximize gains.

Common Mistakes to Avoid in Retracement in Forex

- Ignoring Market Context: Always consider overall market trends before using Fibonacci retracement.

- Relying on Fibonacci Alone: Always use it in conjunction with other technical indicators.

- Drawing Fibonacci Incorrectly: Ensure you select the correct swing high and swing low to get accurate levels.

Conclusion on How to Use Fibonacci Retracement in Forex Trading

Fibonacci retracement is a valuable tool for forex traders looking to identify potential price pullbacks and trading opportunities. By understanding how to properly apply Fibonacci levels, combining them with other technical indicators, and using sound risk management, traders can enhance their decision-making process and improve their trading success. Start practicing Fibonacci retracement in a demo account before using it in live trading to gain confidence in its effectiveness.