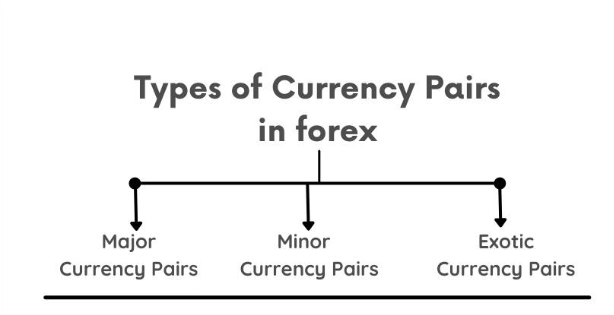

Major, Minor, and Exotic Currency Pairs: What You Need to Know

When trading in the foreign exchange (forex) market, understanding different types of currency pairs is essential. Traders categorize currency pairs into three groups: major, minor, and exotic. Each category has unique characteristics, liquidity levels, and trading opportunities. In this blog post, we’ll explore what you need to know about these currency pairs and how they impact your trading strategy.

Major Currency Pairs

Major currency pairs are the most liquid and widely traded pairs in the forex market. They always include the US dollar (USD) as either the base or quote currency and are paired with the world’s strongest economies. Because of their high liquidity, major pairs typically have tighter spreads and lower transaction costs.

Examples of Major Currency Pairs:

- EUR/USD (Euro / US Dollar)

- USD/JPY (US Dollar / Japanese Yen)

- GBP/USD (British Pound / US Dollar)

- USD/CHF (US Dollar / Swiss Franc)

- AUD/USD (Australian Dollar / US Dollar)

- USD/CAD (US Dollar / Canadian Dollar)

- NZD/USD (New Zealand Dollar / US Dollar)

Characteristics of Major Pairs:

- High liquidity and trading volume

- Lower spreads due to strong demand

- Less volatility compared to minor and exotic pairs

- Strong correlation with global economic news and monetary policies

Minor Currency Pairs

Minor currency pairs, or cross-currency pairs, do not include the US dollar. Instead, they feature other strong global currencies, such as the euro (EUR), British pound (GBP), or Japanese yen (JPY). Due to lower trading volumes, these pairs tend to have slightly higher spreads than major pairs but still offer good liquidity.

Examples of Minor Currency Pairs:

- EUR/GBP (Euro / British Pound)

- EUR/AUD (Euro / Australian Dollar)

- GBP/JPY (British Pound / Japanese Yen)

- AUD/JPY (Australian Dollar / Japanese Yen)

- CHF/JPY (Swiss Franc / Japanese Yen)

Characteristics of Minor Pairs:

- No US dollar involvement

- Moderate liquidity and trading volume

- Wider spreads compared to major pairs

- Influenced by regional economic developments and policies

Exotic Currency Pairs

Exotic currency pairs consist of one major currency and a currency from a smaller or emerging market economy. These pairs have lower liquidity and higher volatility, making them riskier to trade. Exotic pairs also tend to have wider spreads, meaning higher transaction costs for traders.

Examples of Exotic Currency Pairs:

- USD/TRY (US Dollar / Turkish Lira)

- EUR/SGD (Euro / Singapore Dollar)

- GBP/ZAR (British Pound / South African Rand)

- USD/MXN (US Dollar / Mexican Peso)

- AUD/BRL (Australian Dollar / Brazilian Real)

Characteristics of Exotic Pairs:

- Lower liquidity and trading volume

- Higher volatility due to economic instability

- Wider spreads and higher transaction costs

- Strong impact from political and economic events in emerging markets

Choosing the Right Currency Pairs for Trading

When selecting currency pairs to trade, consider the following factors:

- Liquidity: If you prefer steady price movements and lower spreads, major pairs are ideal.

- Volatility: If you seek high-risk, high-reward trades, exotic pairs may be suitable but require careful risk management.

- Trading Hours: Some pairs are more active during specific sessions (e.g., GBP/JPY during the London and Tokyo sessions).

- Market Conditions: Economic news, central bank policies, and geopolitical events can influence currency pair movements.

Final Thoughts on Exotic Currency

Understanding the differences between major, minor, and exotic currency pairs is crucial for developing an effective trading strategy. While major pairs offer stability and lower costs, minor and exotic pairs present unique opportunities and risks. By aligning your trading style with the characteristics of these currency pairs, you can make more informed decisions and enhance your forex trading experience.