Fundamental vs. Technical Analysis: Which One Should You Use?

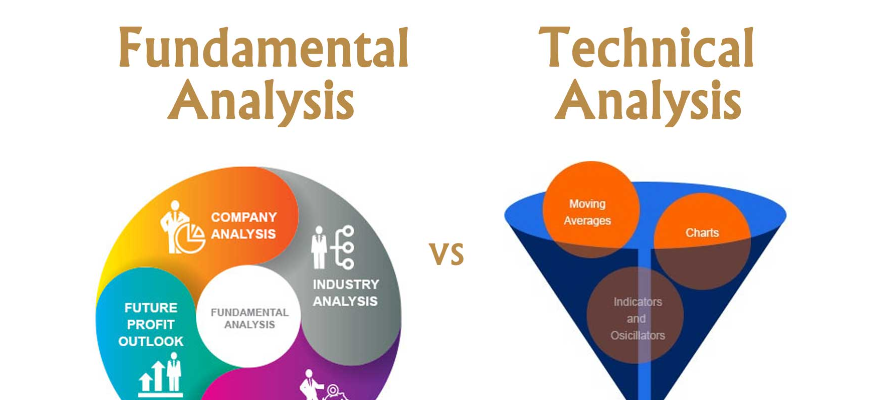

When it comes to investing in the stock market, two main approaches dominate the decision-making process: fundamental analysis and technical analysis. Both methods offer valuable insights, but they serve different purposes and cater to different types of investors. Understanding the strengths and weaknesses of each can help you determine which approach (or combination) suits your investment strategy best.

What is Fundamental Analysis?

Fundamental analysis involves evaluating a company’s financial health, industry position, and overall economic conditions. Investors using this method look at factors such as:

- Earnings Reports: Revenue, net income, and profit margins.

- Balance Sheets: Assets, liabilities, and shareholder equity.

- Economic Indicators: Interest rates, inflation, and GDP growth.

- Industry Trends: Competitive advantages and market share.

Fundamental analysis aims to determine whether a stock is undervalued or overvalued compared to its intrinsic value. Long-term investors, including Warren Buffett, rely heavily on this approach to make investment decisions.

Pros of Fundamental Analysis

✔ Helps identify long-term investment opportunities.

✔ Based on real financial data and economic trends.

✔ Less influenced by short-term market fluctuations.

Cons of Fundamental Analysis

✘ Requires extensive research and financial knowledge.

✘ Market prices can remain irrational for long periods.

✘ Does not provide precise entry and exit points.

What is Technical Analysis?

Technical analysis, on the other hand, focuses on price movements and trading volume. Instead of looking at a company’s financials, technical analysts study charts and patterns to predict future price trends. Common tools include:

- Price Charts: Candlestick, bar, and line charts.

- Indicators: Moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence).

- Patterns: Head and shoulders, triangles, double tops, and bottoms.

- Volume Analysis: How trading volume affects price movements.

The primary goal of technical analysis is to identify short-term trading opportunities based on market sentiment and momentum.

Pros of Technical Analysis

✔ Useful for short-term traders and active investors.

✔ Helps identify precise entry and exit points.

✔ Can be applied to any market (stocks, forex, crypto, etc.).

Cons of Technical Analysis

✘ Does not consider a company’s financial health.

✘ Can be subjective—different traders interpret charts differently.

✘ Market trends do not always follow historical patterns.

Which One Should You Use?

The answer depends on your investment goals, time horizon, and risk tolerance.

- Long-Term Investors: Fundamental analysis is preferable, as it helps in identifying solid companies with strong growth potential.

- Short-Term Traders: Technical analysis is more effective, as it helps in spotting trends and price movements.

- Hybrid Approach: Many investors use both methods. They rely on fundamental analysis to find strong companies and technical analysis to determine the best entry and exit points.

Conclusion

Neither fundamental nor technical analysis is inherently superior. They serve different purposes and cater to different investor needs. By understanding their strengths and weaknesses, you can decide which approach aligns with your investment strategy—or even combine both for a well-rounded perspective.