The Importance of Critical Illness and Disability Insurance

Life is unpredictable. One moment, you’re living your daily routine, and the next, an unexpected illness or accident can turn your world upside down. While we all hope for the best, being financially prepared for the worst is essential. That’s where critical illness and disability insurance come into play. These insurance policies provide much-needed financial security during life’s most challenging times, ensuring that you and your loved ones can focus on recovery rather than worrying about expenses.

What is Critical Illness Insurance?

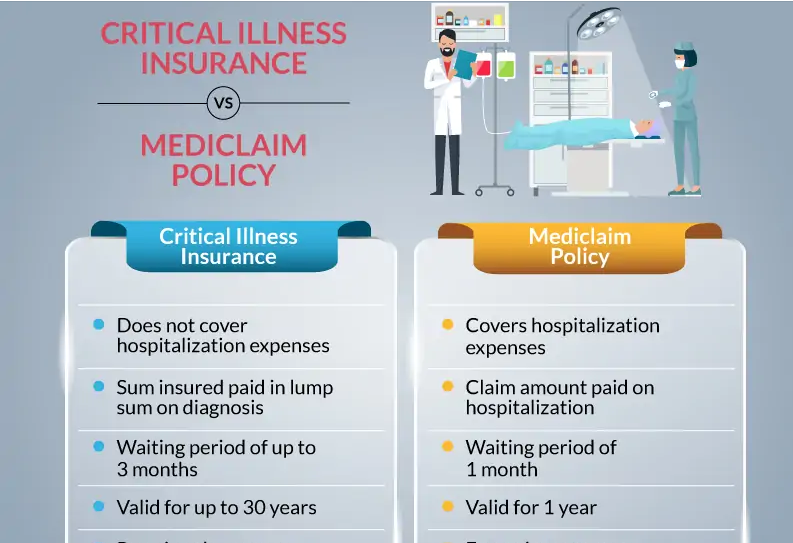

Critical illness insurance is a policy that provides a lump sum payout if you are diagnosed with a covered serious illness, such as cancer, heart attack, or stroke. Unlike traditional health insurance, which may only cover medical costs, critical illness insurance offers a cash benefit that can be used however you see fit—whether for medical bills, household expenses, lost income, or even seeking specialized treatments.

Why It Matters:

- Rising Medical Costs – Even with health insurance, out-of-pocket expenses for serious illnesses can be overwhelming. Critical illness insurance helps bridge the gap.

- Loss of Income – Many people diagnosed with a critical illness are unable to work for extended periods. The payout can replace lost wages, helping maintain financial stability.

- Freedom of Choice – You can use the funds for any necessary expenses, such as mortgage payments, childcare, or alternative treatments not covered by traditional insurance.

What is Disability Insurance?

Disability insurance provides income replacement if you become unable to work due to an illness or injury. There are two main types: short-term disability insurance (which typically covers a few months) and long-term disability insurance (which can last for years or even until retirement, depending on the policy).

Why It Matters:

- Income Protection – Your ability to earn an income is one of your greatest financial assets. Disability insurance ensures that a portion of your salary is still coming in if you’re unable to work.

- Bills Don’t Stop – Mortgage or rent, utilities, and daily expenses continue even if you’re unable to work. Disability insurance helps cover these ongoing costs.

- Peace of Mind – Knowing you have a safety net in place allows you to focus on recovery without the added stress of financial hardship.

Who Needs These Policies?

While everyone can benefit from critical illness and disability insurance, certain individuals may find them particularly crucial:

- Self-Employed Individuals – Without employer-sponsored benefits, self-employed workers need their own coverage for financial security.

- Primary Breadwinners – If your family relies on your income, losing it due to illness or disability could be devastating.

- People with High Medical Expenses – Those with a family history of serious illnesses should consider additional protection.

Final Thoughts

No one expects to face a life-altering illness or disability, but preparing for the unexpected is a key part of financial planning. Critical illness and disability insurance provide an essential safety net, ensuring that if the worst happens, you and your loved ones are protected from financial ruin. Investing in these policies today could make all the difference in securing your future tomorrow.

Take the time to assess your needs and explore the options available. The peace of mind that comes with being financially prepared is priceless.