The 50/30/20 Rule: A Simple Approach to Managing Your Money

Managing money can feel overwhelming, especially with bills, savings goals, and unexpected expenses. The 50/30/20 rule is a simple and effective budgeting method that helps you allocate your income wisely while maintaining financial stability. Whether you’re new to budgeting or looking for a practical way to manage your finances, this rule can help you save, spend, and invest smartly.

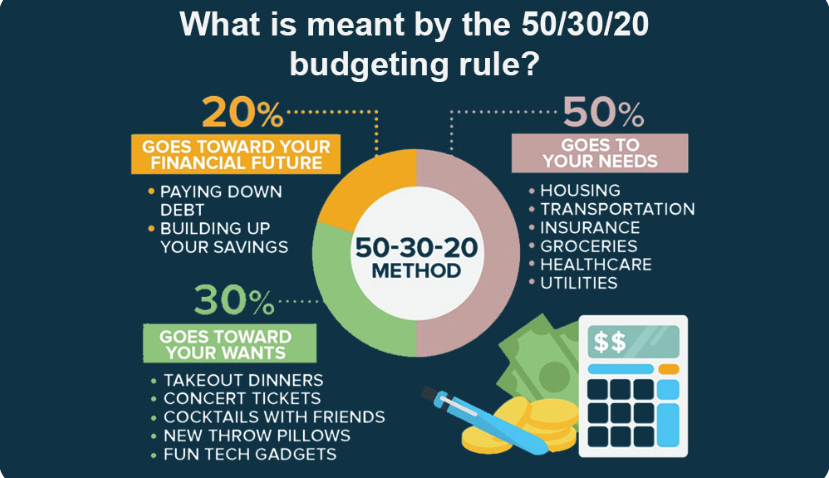

What is the 50/30/20 Rule?

The 50/30/20 rule, popularized by Senator Elizabeth Warren in her book All Your Worth: The Ultimate Lifetime Money Plan, divides your after-tax income into three categories:

✅ 50% for Needs – Essential expenses like rent, groceries, and bills.

✅ 30% for Wants – Lifestyle choices such as entertainment, dining out, and vacations.

✅ 20% for Savings & Debt Repayment – Emergency fund, investments, and paying off debt.

This method ensures a balanced financial approach—covering necessities, allowing enjoyment, and prioritizing future security.

How to Apply the 50/30/20 Rule

Step 1: Calculate Your After-Tax Income

Before applying the rule, determine your monthly income after taxes (net income). If you’re an employee, check your paycheck for your take-home pay. If you’re self-employed, subtract business expenses and taxes from your earnings.

💡 Example:

- Salary: $4,000 per month (after taxes)

- Applying the 50/30/20 rule:

- Needs: $2,000 (50%)

- Wants: $1,200 (30%)

- Savings/Debt Repayment: $800 (20%)

Step 2: Allocate 50% to Needs

Your needs are the essentials required to maintain a basic standard of living.

Common needs include:

✔ Rent or mortgage payments

✔ Utilities (electricity, water, internet)

✔ Groceries

✔ Insurance (health, car, home)

✔ Minimum debt payments (loans, credit cards)

✔ Transportation (gas, public transit)

🔹 Tip: If your needs exceed 50%, look for areas to cut costs, such as refinancing loans or reducing utility bills.

Step 3: Allocate 30% to Wants

Your wants are non-essential expenses that enhance your lifestyle and bring enjoyment.

Examples of wants:

✔ Dining out and entertainment

✔ Shopping for clothes and gadgets

✔ Gym memberships and hobbies

✔ Travel and vacations

✔ Streaming services and subscriptions

💡 Tip: If you need to save more or pay off debt faster, consider cutting down on wants temporarily.

Step 4: Allocate 20% to Savings & Debt Repayment

This portion is crucial for building financial security and achieving long-term goals.

Where to allocate this 20%:

✔ Emergency fund – Aim for 3-6 months of expenses saved.

✔ Retirement savings – Contribute to a 401(k), IRA, or other investment plans.

✔ Investments – Stocks, real estate, or other passive income opportunities.

✔ Extra debt payments – Pay down high-interest debts faster.

💡 Tip: If you don’t have an emergency fund, prioritize it first before investing in other assets.

Benefits of the 50/30/20 Rule

✅ Simple & Easy to Follow – No complicated spreadsheets or formulas.

✅ Balances Spending & Saving – Helps you live comfortably while preparing for the future.

✅ Reduces Financial Stress – Ensures you’re covering essentials and avoiding overspending.

✅ Encourages Smart Financial Habits – Helps control unnecessary expenses and build wealth.

Adapting the Rule to Your Financial Situation

While the 50/30/20 rule is a great guideline, you may need to adjust the percentages based on your personal financial situation.

📌 High cost of living? Your needs might take up 60%, so adjust wants to 20% and savings to 20%.

📌 Trying to save aggressively? Reduce wants to 20% and increase savings to 30%.

📌 Deep in debt? Prioritize debt repayment and adjust accordingly.

Final Thoughts

The 50/30/20 rule is a straightforward and effective way to take control of your finances. By budgeting smartly, you can enjoy life while securing your financial future.

🔹 Start today: Review your income, categorize expenses, and make adjustments where needed.