Myths About Loans Debunked: What You Need to Know

When it comes to loans, misinformation is everywhere. Many people shy away from borrowing because of myths that have been circulating for years. These misconceptions can prevent individuals from making informed financial decisions that could benefit them. In this post, we’ll debunk some of the most common myths about loans and set the record straight.

Myths 1: Taking Out a Loan Will Ruin Your Credit Score

Many believe that simply applying for or taking out a loan will immediately damage their credit score. The truth is, while applying for a loan may result in a small, temporary dip in your credit score due to a hard inquiry, responsible borrowing can improve your credit in the long run. Making timely payments and keeping your debt manageable demonstrates financial responsibility, which can boost your credit score over time.

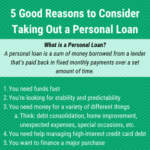

Myth 2: You Should Always Avoid Debt

Not all debt is bad. While excessive or mismanaged debt can lead to financial problems, loans can be valuable financial tools when used wisely. For example, student loans, home mortgages, and business loans can help individuals invest in their future. The key is to borrow responsibly and ensure the loan aligns with your financial goals.

Myths 3: You Can’t Get a Loan with Bad Credit

Having bad credit can make it more challenging to secure a loan, but it doesn’t make it impossible. Many lenders offer loans specifically for individuals with low credit scores. While these loans may come with higher interest rates, they provide an opportunity to rebuild credit by making timely payments. Exploring options such as secured loans or finding a co-signer can also help individuals with lower credit scores qualify for loans.

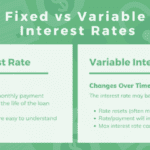

Myths 4: You Should Always Choose the Loan with the Lowest Interest Rate

While a low interest rate is an important factor, it shouldn’t be the only consideration when selecting a loan. Other factors, such as loan terms, fees, repayment flexibility, and hidden charges, can impact the overall cost of borrowing. A loan with a slightly higher interest rate but better repayment terms may be more cost-effective in the long run.

Myth 5: You Can’t Pay Off a Loan Early Without Penalties

Some borrowers assume that they’ll be penalized for paying off a loan early. While certain loans do come with prepayment penalties, many do not. It’s important to read the terms and conditions of your loan agreement before assuming that early repayment will result in extra fees. Paying off a loan early can save you money on interest and help you become debt-free sooner.

Myth 6: Loan Approval Means You Can Afford It

Just because a lender approves you for a loan doesn’t mean it’s the right financial decision. Lenders assess your eligibility based on income, credit history, and other financial factors, but they don’t consider your long-term financial goals or daily expenses. Before accepting a loan, consider your budget and financial commitments to ensure you can comfortably make payments without financial strain.

Final Thoughts

Understanding the truth behind these loan myths can empower you to make better financial decisions. Loans, when used responsibly, can help you achieve major life goals, from buying a home to starting a business. Before taking out a loan, always research your options, read the terms carefully, and ensure they align with your financial plan. By staying informed, you can avoid falling for common misconceptions and use loans to your advantage.