Understanding Loan Terms: APR, Principal, and Fees

Taking out a loan is a significant financial decision that can impact your budget for years to come. Whether you’re borrowing for a car, a home, or personal expenses, understanding key loan terms is essential. In this post, we’ll break down three crucial components of any loan: APR, principal, and fees.

Here are Some of The Loan Terms

1. APR (Annual Percentage Rate)

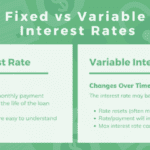

The Annual Percentage Rate (APR) is the total cost of borrowing expressed as a yearly percentage. Unlike the interest rate, which only accounts for the cost of borrowing the principal, the APR includes additional fees and costs associated with the loan. This makes the APR a more comprehensive measure of the loan’s true cost.

For example, a loan with a 5% interest rate may have an APR of 5.5% if it includes processing fees or other charges. When comparing loans, the APR is a more reliable indicator of affordability than just the interest rate alone.

2. Principal

The principal is the original amount of money you borrow from a lender. If you take out a $10,000 loan, your principal is $10,000. Each payment you make reduces the principal over time, but a portion of your payment also goes toward interest.

A lower principal generally means lower interest costs, making it beneficial to borrow only what you truly need. Additionally, making extra payments toward your principal can reduce the total interest you pay over the life of the loan.

3. Fees

Loans often come with various fees that can add to the overall borrowing cost. Some common loan fees include:

- Origination Fees: A one-time charge for processing the loan.

- Late Payment Fees: Charges for missing a due date.

- Prepayment Penalties: Fees for paying off a loan early.

- Annual Fees: Recurring costs on some types of loans, like credit lines.

Understanding these fees can help you avoid unexpected expenses and choose a loan with the most favorable terms.

Final Thoughts

Before committing to a loan, always read the fine print and ask your lender about the APR, principal, and fees involved. Comparing different loan offers and understanding these key terms will empower you to make informed financial decisions and save money in the long run.

If you’re considering a loan, take the time to shop around and ask questions. A little research upfront can lead to significant savings over time.