Introduction to Insurance: What It Is and Why You Need It

What Is Insurance?

Insurance is a financial safety net designed to protect individuals, businesses, and assets from unexpected risks. It works by pooling resources from policyholders to cover potential losses, ensuring financial stability in times of crisis. In exchange for regular payments, known as premiums, an insurance company provides compensation for specific losses, damages, or liabilities outlined in the policy.

Why Do You Need Insurance?

Life is unpredictable, and unexpected events can lead to significant financial burdens. It helps mitigate these risks by offering protection against unforeseen circumstances. Here are some key reasons why insurance is essential:

1. Financial Security

Accidents, natural disasters, medical emergencies, and other unfortunate events can drain your savings. It ensures that you or your loved ones are financially protected from such hardships.

2. Legal Requirements

Certain types of protection, such as auto assurance and workers’ compensation, are legally mandated. Having the required coverage ensures compliance with laws and regulations.

3. Peace of Mind

Knowing that you have a safety net in place allows you to focus on your personal and professional life without constant worry about potential financial setbacks.

4. Protection for Loved Ones

Life-insurance, for example, ensures that your family is financially secure in the event of your passing. This coverage can help with funeral expenses, outstanding debts, and ongoing living costs.

5. Safeguarding Assets

Home, auto, and property assurance help protect your valuable assets from damage, theft, or destruction, reducing financial loss and aiding in recovery.

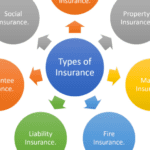

Common Types of Insurance

There are various types to cater to different needs. Some of the most common ones include:

- Health Insurance – Covers medical expenses, including doctor visits, hospital stays, and treatments.

- Life Insurance – Provides financial support to beneficiaries after the policyholder’s death.

- Auto Insurance – Protects against financial losses due to vehicle accidents, theft, or damage.

- Homeowners/Renters Insurance – Covers property damage, personal belongings, and liability in case of accidents at home.

- Disability Insurance – Offers income replacement if you’re unable to work due to illness or injury.

- Business Insurance – Protects businesses from financial risks, including property damage, liability claims, and employee-related risks.

How to Choose the Right One

Selecting the right one depends on your unique needs, lifestyle, and financial situation. Here are some key factors to consider:

- Assess Your Risks – Identify potential risks that could impact your finances.

- Compare Policies – Research different insurance providers and compare coverage, premiums, and benefits.

- Understand Policy Terms – Read the fine print to know what is covered and any exclusions.

- Seek Professional Advice – Consult a financial advisor to make informed decisions.