How to Start Investing in Stocks as a Beginner

Investing in stocks is one of the most effective ways to build wealth over time. However, if you’re a beginner, the world of stocks can seem overwhelming. You can navigate the market confidently and start growing your investments with the right approach. Here’s a step-by-step guide to help you begin your journey into stock investing.

1. Understand the Basics of Stock Investing

Before you start investing, it’s important to understand what stocks are. Stocks represent ownership in a company, and when you buy shares, you become a partial company owner. Stock prices fluctuate based on the company’s performance and market conditions, offering opportunities for profit (or loss).

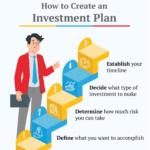

2. Set Clear Investment Goals

Ask yourself: What do you want to achieve with investing? Are you looking for long-term growth, short-term gains, or passive income through dividends? Understanding your goals will help you determine your investment strategy.

3. Choose the Right Investment Approach

There are different ways to invest in stocks:

- Individual Stocks: You can buy shares of specific companies.

- Exchange-Traded Funds (ETFs) and Mutual Funds: These funds pool money from multiple investors to invest in a diversified portfolio of stocks.

- Index Funds: These track major stock indices like the S&P 500 and provide broad market exposure.

Beginners may find ETFs and index funds a safer way to start, as they offer diversification and lower risk compared to investing in individual stocks.

4. Open a Brokerage Account

To buy and sell stocks, you need a brokerage account. Research and choose a brokerage platform that fits your needs, considering factors such as fees, ease of use, available investment options, and customer support. Popular platforms include Fidelity, Charles Schwab, TD Ameritrade, and Robinhood.

5. Start with a Small Investment

It’s wise to start small while you learn. Many brokers offer fractional shares, allowing you to invest in expensive stocks with as little as $10. This helps you get comfortable with investing without risking large amounts of money.

6. Research Before You Invest

Before buying any stock, research the company’s financial health, industry position, and growth potential. Key factors to consider include revenue, earnings, market trends, and leadership. Websites like Yahoo Finance, Bloomberg, and company reports provide valuable insights.

7. Diversify Your Portfolio

Diversification helps reduce risk by spreading your investments across different sectors and asset classes. Instead of putting all your money in one stock, consider investing in multiple companies or ETFs.

8. Adopt a Long-Term Mindset

Stock markets can be volatile, and short-term fluctuations are normal. Successful investors focus on long-term growth and avoid reacting emotionally to market swings. Consistently investing over time (dollar-cost averaging) can help smooth out volatility.

9. Keep Learning and Stay Updated

The stock market evolves constantly. Keep educating yourself through books, financial news, and investment courses. Some great books for beginners include The Intelligent Investor by Benjamin Graham and One Up on Wall Street by Peter Lynch.

10. Monitor and Adjust Your Portfolio

Regularly review your investments to ensure they align with your goals. Rebalance your portfolio if needed, but avoid excessive trading based on market hype.

Conclusion

Starting your journey in stock investing may seem daunting, but with patience and the right knowledge, you can build a successful portfolio. Begin with small investments, stay consistent, and focus on long-term growth. Over time, your investments can grow and contribute to your financial future. Happy investing!