How to Set Investment Goals Based on Your Financial Situation

Investing is a powerful way to grow your wealth over time, but setting the right investment goals is essential to achieving financial success. Your investment strategy should be tailored to your unique financial situation, risk tolerance, and long-term aspirations. Here’s a step-by-step guide to setting investment goals that align with your financial circumstances.

1. Assess Your Current Financial Situation

Before setting any investment goals, it’s crucial to understand where you currently stand financially. Consider the following factors:

- Income & Expenses: Track your monthly income and spending habits to determine how much you can afford to invest.

- Debt Levels: Pay attention to high-interest debts, like credit cards, which should be prioritized before aggressive investing.

- Emergency Fund: Ensure you have a savings buffer (typically 3-6 months of living expenses) before taking on investment risks.

- Retirement Contributions: Check if you’re taking advantage of employer-sponsored retirement plans or IRAs.

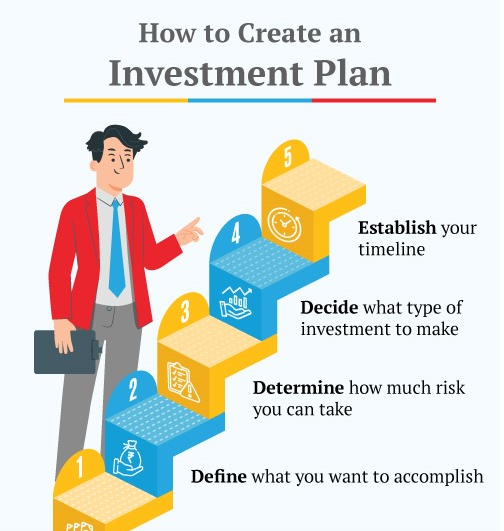

2. Define Your Investment Objectives

Once you have a clear picture of your financial standing, identify what you hope to achieve with your investments. Common investment goals include:

- Short-Term Goals (1-5 years): Buying a home, saving for a wedding, or funding a vacation.

- Medium-Term Goals (5-10 years): Starting a business, paying for higher education, or purchasing investment property.

- Long-Term Goals (10+ years): Retirement planning, building generational wealth, or achieving financial independence.

3. Determine Your Risk Tolerance

Your ability to take financial risks depends on factors like age, financial obligations, and personal comfort level. Risk tolerance typically falls into three categories:

- Conservative: Prioritizing capital preservation with low-risk assets like bonds or savings accounts.

- Moderate: Balancing risk and reward with a mix of stocks, bonds, and real estate.

- Aggressive: Focusing on high-risk, high-reward investments such as stocks, startups, or cryptocurrencies.

4. Choose the Right Investment Vehicles

Selecting appropriate investment options depends on your financial goals and risk appetite:

- For Short-Term Goals: High-yield savings accounts, certificates of deposit (CDs), or low-risk bonds.

- For Medium-Term Goals: Index funds, ETFs, dividend stocks, or real estate investments.

- For Long-Term Goals: Retirement accounts (401(k), IRA), growth stocks, mutual funds, and REITs.

5. Set Realistic and Measurable Goals

To keep your investments on track, follow the SMART framework:

- Specific: Define clear goals (e.g., save $50,000 for a down payment in 5 years).

- Measurable: Track progress using investment returns and contribution rates.

- Achievable: Ensure goals align with your income and expenses.

- Relevant: Focus on investments that fit your risk tolerance and time horizon.

- Time-Bound: Set deadlines for each financial objective.

6. Regularly Review and Adjust Your Strategy

Financial circumstances change over time, so it’s essential to review and adjust your investment plan accordingly. Reassess your portfolio annually, rebalance assets as needed, and adapt your goals based on life events like marriage, job changes, or market conditions.

Final Thoughts

Setting investment goals based on your financial situation ensures a more strategic and rewarding approach to building wealth. By assessing your finances, defining clear objectives, managing risks, and choosing the right investment vehicles, you can create a path to financial success. Start today, stay disciplined, and watch your investments grow over time!

What are your top investment goals? Share your thoughts in the comments below!