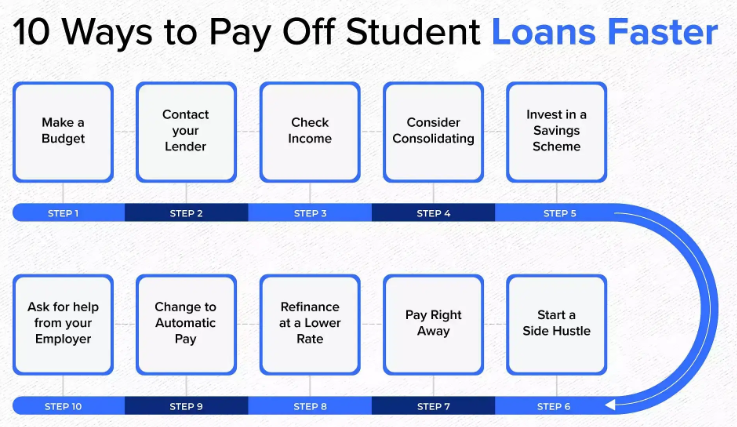

How to Repay Your Student Loan Faster and Save Money

Student loans can feel like a financial burden, but with the right strategies, you can pay them off faster and save money in the process. Whether you’re dealing with federal or private loans, taking proactive steps can reduce interest costs and help you achieve financial freedom sooner. Here’s how you can repay faster and save money:

1. Make More Than the Minimum Payment

Most student loan repayment plans have a minimum monthly payment, but paying only the minimum means you’ll be in debt longer and pay more in interest. If possible, increase your monthly payment or make extra payments whenever you can. Even an additional $50 per month can make a significant difference over time.

2. Refinance Your Student Loans

Refinancing your student loans can help lower your interest rate, which reduces the total amount you pay over the life of the loan. This strategy is particularly beneficial if you have high-interest private loans. However, if you have federal loans, be cautious—refinancing may cause you to lose access to federal benefits like income-driven repayment and loan forgiveness programs.

3. Take Advantage of Employer Repayment Assistance

Some employers offer student loan repayment assistance as part of their benefits package. Check with your HR department to see if your company provides this benefit and take full advantage of it if available.

4. Make Biweekly Payments

Instead of making one monthly payment, consider splitting your payment in half and paying every two weeks. This results in an extra full payment each year, helping you pay off your loan faster while reducing interest costs.

5. Apply Windfalls Toward Your Loan

Whenever you receive unexpected money—such as a tax refund, work bonus, or inheritance—consider putting it toward your student loan. Lump-sum payments can significantly reduce your principal balance and save you money on interest.

6. Enroll in Autopay for Interest Rate Discounts

Many lenders offer a small interest rate reduction (typically 0.25%) if you enroll in automatic payments. While it might not seem like much, this discount can add up over time and help you save money.

7. Live Below Your Means

Cutting back on unnecessary expenses can free up more money to put toward your student loans. Simple lifestyle changes like cooking at home, canceling unused subscriptions, and shopping smarter can help you pay off debt more quickly and save money.

8. Consider the Debt Snowball or Avalanche Method

Two popular repayment strategies include:

- Debt Snowball: Pay off the smallest loan first while making minimum payments on the others. Once the smallest loan is gone, move to the next smallest.

- Debt Avalanche: Focus on paying off the loan with the highest interest rate first while making minimum payments on the others in order to save money.

Both methods can be effective, so choose the one that best suits your motivation style and financial goals.

9. Look Into Loan Forgiveness Programs

If you have federal student loans, check if you qualify for loan forgiveness programs like Public Service Loan Forgiveness (PSLF) or Teacher Loan Forgiveness. These programs can help eliminate some or all of your remaining loan balance after meeting certain requirements.

10. Increase Your Income

Finding ways to boost your income, such as taking on a side hustle, freelancing, or asking for a raise, can give you extra cash to put toward your student loans. Even a small increase in income can accelerate your repayment plan.

Final Thoughts

Repaying your student loans faster requires a combination of smart financial habits, strategic planning, and a commitment to reducing debt. By following these tips, you’ll not only pay off your loans sooner but also save money in interest. The sooner you become debt-free, the sooner you can focus on building wealth and achieving your financial goals.