Home Equity Loans vs. HELOCs: Which is Right for You?

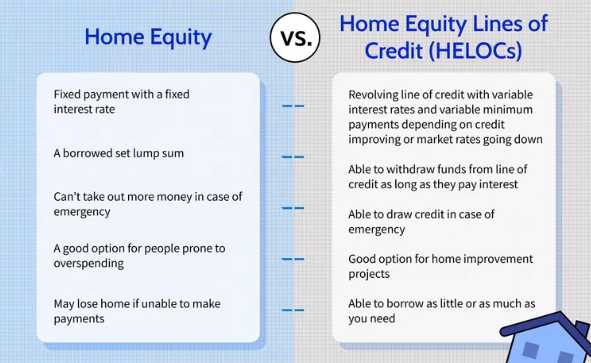

If you’re a homeowner looking to tap into your home’s equity, you’ve likely come across two popular options: home equity loans and home equity lines of credit (HELOCs). While both allow you to borrow against your home’s value, they work differently. Understanding their differences can help you decide which is best suited to your financial needs.

What is a Home Equity Loan?

An equity loan is a fixed-term loan that allows you to borrow a lump sum against the equity in your home. It comes with a fixed interest rate and a set repayment schedule, typically ranging from five to thirty years. Since payments remain consistent over time, a home equity loan is ideal for those who need predictable monthly payments.

Pros of Home Equity Loans:

- Fixed interest rates provide stability

- Lump sum funding is useful for large expenses (e.g., home renovations, debt consolidation)

- Predictable monthly payments simplify budgeting

Cons of Home Equity Loans:

- Interest rates may be higher than those of HELOCs (especially initially)

- You must borrow a set amount upfront, whether you need it all or not

- Less flexibility compared to a HELOC

What is a HELOC?

A HELOC is a revolving line of credit that allows you to borrow funds as needed, up to a predetermined limit, similar to a credit card. It usually comes with a variable interest rate, meaning payments can fluctuate. The HELOC consists of two phases:

- Draw period (usually 5–10 years): You can borrow, repay, and borrow again.

- Repayment period (usually 10–20 years): You must repay the balance in full, typically with higher monthly payments.

Pros of HELOCs:

- Flexible borrowing: You can withdraw funds as needed

- Typically lower initial interest rates compared to home equity loans

- Interest-only payments during the draw period can ease financial strain

Cons of HELOCs:

- Variable interest rates may cause payments to increase over time

- Requires discipline to avoid overspending

- Lenders may reduce or freeze the credit line during economic downturns

Which One is Right for You?

Your choice between a home equity loan and a HELOC depends on your financial situation and goals:

- Choose a home equity loan if you need a large, one-time sum for a specific expense and prefer stable monthly payments.

- Choose a HELOC if you want ongoing access to funds, flexibility, and the ability to handle potential payment fluctuations.

Before making a decision, assess your financial stability, compare interest rates, and consult a financial advisor to ensure the best choice for your needs. Understanding these options allows you to leverage your home’s equity wisely and achieve your financial goals.