When Should You Take a Personal Loan?

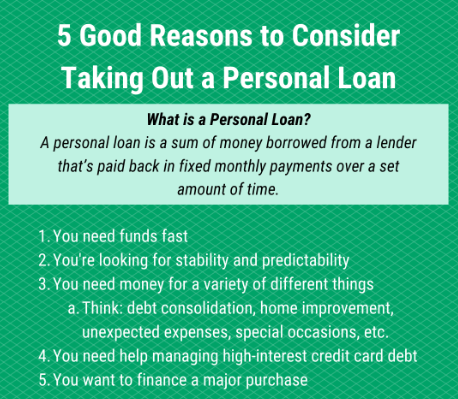

A personal loan can be a great financial tool when used wisely. It provides quick access to cash, usually without requiring collateral, and can be used for various purposes. However, like any financial decision, it’s important to evaluate whether taking a personal loan is the right choice for your situation. Below are some common scenarios where a personal loan can be beneficial.

1. Debt Consolidation

If you have multiple high-interest debts, such as credit card balances, a personal loan can be used to consolidate them into a single loan with a lower interest rate. This can make repayment more manageable and save you money on interest over time.

2. Emergency Expenses

Unexpected medical bills, home repairs, or urgent travel needs can put a strain on your finances. If you don’t have an emergency fund, a personal loan can help you cover these expenses without resorting to high-interest credit cards or payday loans.

3. Home Improvement Projects

Personal loan can be a good alternative to a home equity loan or line of credit if you need funds for home renovations. It allows you to improve your property’s value without using your home as collateral.

4. Major Life Events

Weddings, moving costs, or adoption expenses can be significant. If you don’t have enough savings but want to cover these costs responsibly, a personal loan can help you finance them without depleting your cash reserves.

5. Higher Education or Skill Development

While student loans are typically the go-to option for education, some people use personal loans for courses, certifications, or professional development when other financing options aren’t available.

When Should You Avoid a Personal Loan?

Although personal loans can be useful, they’re not always the best solution. Here are some instances when you should reconsider:

- For unnecessary luxury purchases – Using a loan to fund vacations, gadgets, or non-essential expenses can lead to financial strain.

- If you can’t afford the repayments – Taking a loan without a clear repayment plan can hurt your credit score and overall financial health.

- If you qualify for better options – Sometimes, credit cards with 0% APR promotions or lower-interest secured loans might be better choices.

Final Thoughts

A personal loan can be a smart financial decision if it helps you consolidate debt, cover an emergency, or invest in something valuable. However, always compare interest rates, read the terms carefully, and ensure you have a solid repayment plan before borrowing.

If you’re considering a personal loan, take the time to research different lenders and loan options to find the best fit for your financial situation.