Understanding Market Cycles: When to Buy and When to Sell

Investing in financial markets can be rewarding, but it requires a keen understanding of market cycles. These cycles dictate price movements and can help investors decide when to buy and when to sell. In this post, we’ll explore the different phases of market cycles and how you can use them to your advantage.

What Are Market Cycles?

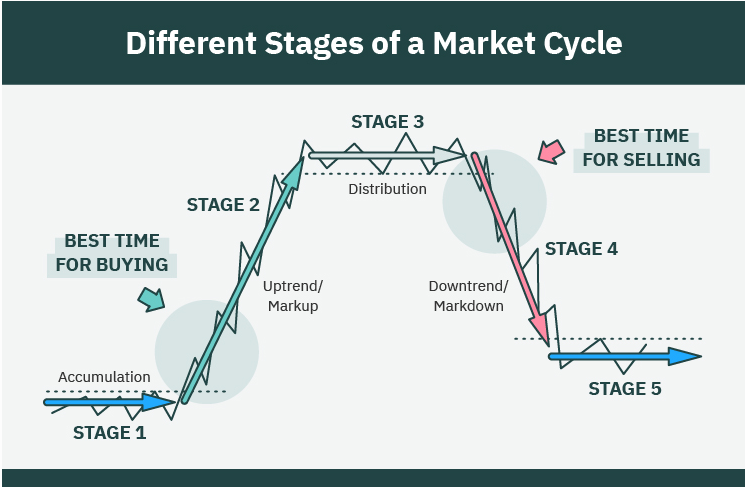

Market cycles are recurring patterns of expansion and contraction in financial markets. While the length and intensity of each cycle vary, they typically follow four distinct phases:

- Accumulation Phase – This occurs after a market downturn when prices stabilize, and smart investors (institutions and experienced traders) begin buying assets at a discount.

- Markup Phase – As optimism returns, prices start rising, attracting more investors. This is often the best time for long-term investors to enter the market.

- Distribution Phase – The market reaches its peak, and early investors start selling to lock in profits. Prices may become volatile as supply and demand battle for control.

- Decline (or Markdown) Phase – As selling intensifies, prices drop, and fear takes over. Many inexperienced investors sell at a loss, leading to a market downturn.

When to Buy

Understanding the different phases of a market cycle can help you determine when to buy:

- Accumulation Phase: This is often the best time to buy because prices are low, and smart money is entering the market.

- Early Markup Phase: If you miss the bottom, buying early in the markup phase still offers strong growth potential.

- Pullbacks During Uptrends: Even during a bullish market, short-term corrections happen. These dips can present good buying opportunities.

When to Sell

Knowing when to exit a position is just as crucial as knowing when to enter:

- Late Markup Phase: When prices rise significantly and market euphoria takes hold, it may be time to take some profits.

- Distribution Phase: If signs of weakening momentum appear, such as lower trading volume or negative news, consider selling to protect gains.

- Before or Early in the Markdown Phase: If the market shows clear signs of reversing, selling early can prevent substantial losses.

Key Indicators to Watch

To effectively navigate market cycles, monitor these indicators:

- Market Sentiment: Investor emotions often drive market trends. Extreme fear or greed can signal turning points.

- Volume Trends: Rising prices on decreasing volume can indicate a weakening trend.

- Moving Averages: Technical tools like the 50-day and 200-day moving averages can help identify trends.

- Economic Data: Interest rates, inflation, and GDP growth can influence market direction.

Conclusion

Successful investing requires understanding market cycles and recognizing opportunities to buy and sell strategically. While timing the market perfectly is difficult, using historical patterns, technical indicators, and economic trends can improve decision-making. Stay patient, diversify your portfolio, and invest with a long-term perspective to navigate market cycles effectively.