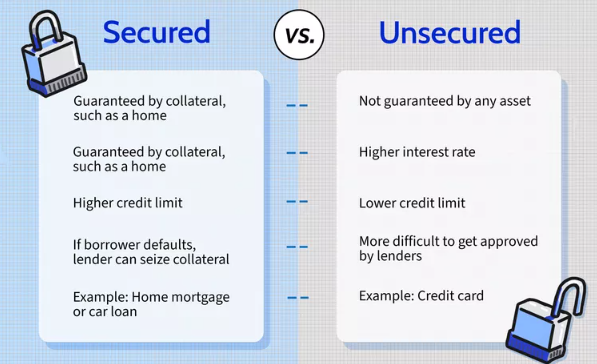

Types of Loans Secured VS Unsecured Loans

When you need to borrow money, you’ll come across two main types of loans: secured and unsecured. Understanding the difference between these loan types can help you make an informed decision and choose the best option for your financial situation.

What Are Secured Loans?

A secured loan is backed by collateral, meaning the borrower must pledge an asset—such as a house, car, or savings account—to secure the loan. Because the lender has a form of security, these loans typically come with lower interest rates and more favorable terms.

Common Types of Secured Loans:

- Mortgage Loans – Home loans where the property itself serves as collateral.

- Auto Loans – Loans for purchasing a vehicle, with the car acting as security.

- Home Equity Loans – Loans where homeowners borrow against the value of their home.

- Secured Personal Loans – Loans backed by assets like savings accounts or certificates of deposit (CDs).

Pros of Secured Loans:

- Lower interest rates

- Higher borrowing limits

- Longer repayment terms

Cons of Secured Loans:

- Risk of losing the collateral if you default

- Longer application and approval process

What Are Unsecured Loans?

An unsecured loan does not require collateral. Instead, lenders approve these loans based on the borrower’s creditworthiness, income, and financial history. Because there’s no asset securing the loan, interest rates tend to be higher.

Common Types of Unsecured Loans:

- Personal Loans – General-purpose loans used for expenses like medical bills, home improvements, or vacations.

- Credit Cards – A form of revolving credit where the borrower can make purchases up to a limit.

- Student Loans – Loans designed to finance education costs without requiring collateral.

- Medical Loans – Loans used to cover healthcare expenses without upfront collateral.

Pros of Unsecured Loans:

- No risk of losing an asset

- Faster approval process

- More flexibility in usage

Cons of Unsecured Loans:

- Higher interest rates

- Lower borrowing limits

- Stricter credit requirements

Which Loan Type Is Right for You?

Choosing between a secured and unsecured loan depends on your financial needs and circumstances. If you have valuable assets and want lower interest rates, a secured loan may be a better option. However, if you don’t want to risk losing an asset and can afford slightly higher interest rates, an unsecured loan might be the right choice.

Before taking out any loan, consider factors like your credit score, repayment ability, and the urgency of the funds needed. Always compare different lenders and read the terms carefully to ensure you’re getting the best deal possible.

By understanding the difference between secured and unsecured loans, you can make an informed decision and borrow responsibly.