The Role of Bounds in a Balanced Investment Strategy

In the world of investing, balance is key. Every prudent investor wants a well-diversified portfolio that manages risk while maximizing returns. One of the most effective ways to maintain this balance is by setting clear bounds on investments. But what exactly are bounds, and why are they essential in a balanced investment strategy?

Understanding Investment Bounds

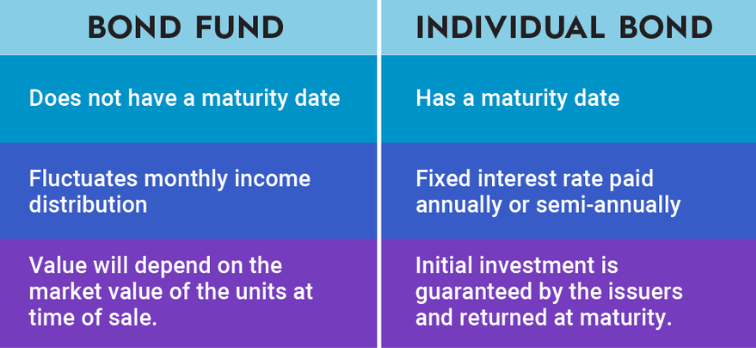

Investment bonds refer to the predefined limits within which an investor allocates their capital. These bounds can take several forms, such as asset allocation ranges, sector exposure limits, or position sizing constraints. By establishing upper and lower limits on different asset classes, sectors, or individual securities, investors can ensure their portfolios remain aligned with their risk tolerance and investment objectives.

The Importance of Bounds in Investment Strategy

- Risk Management

Bounds serve as a safeguard against excessive exposure to high-risk assets. For example, limiting equity exposure to a certain percentage ensures that a portfolio does not become overly volatile during market downturns. Similarly, setting constraints on allocations to emerging markets can prevent excessive risk-taking. - Diversification Control

A balanced portfolio relies on diversification to reduce overall risk. Without clear bounds, investors might unintentionally become over-concentrated in a single asset class or industry. By setting allocation limits, investors can ensure proper diversification and avoid over-reliance on any one sector. - Avoiding Emotional Decisions

Market fluctuations often lead investors to make impulsive decisions, such as panic selling during downturns or chasing returns during bull markets. Predefined bounds help maintain discipline by keeping investment decisions aligned with a long-term strategy rather than short-term emotions. - Enhancing Stability and Predictability

A portfolio with well-defined bounds tends to exhibit more predictable performance over time. By maintaining a steady asset allocation mix, investors can better forecast their potential returns and avoid excessive fluctuations in portfolio value.

How to Implement Bounds in a Portfolio

To effectively integrate bounds into an investment strategy, investors should:

- Define Target Allocation Ranges: Set specific percentage ranges for asset classes, such as 40-60% equities, 30-50% bonds, and 5-15% alternative investments.

- Monitor Regularly: Periodically review portfolio allocations to ensure they remain within the established bounds.

- Rebalance When Necessary: If asset classes drift outside their bounds due to market movements, rebalance by selling over-allocated assets and purchasing under-allocated ones.

- Adjust as Needed: While maintaining discipline is crucial, investors should periodically reassess their bounds to account for changes in financial goals or risk tolerance.

Conclusion

Investment bounds play a crucial role in maintaining a balanced and disciplined investment strategy. By defining clear limits on asset allocation, sector exposure, and individual holdings, investors can manage risk, enhance diversification, and maintain stability in their portfolios. Whether you are a conservative investor looking for steady returns or a more aggressive investor seeking growth, setting appropriate bounds will help you stay on course and achieve your financial objectives.