Term Life vs. Whole Life Insurance: Which One Is Right for You?

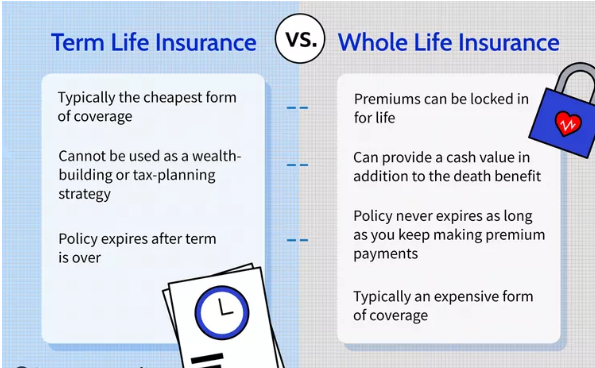

When it comes to life insurance, one of the biggest decisions you’ll face is choosing between term life and whole life insurance. Both offer financial protection for your loved ones, but they work in very different ways. Understanding their key differences can help you determine which one is best suited for your needs.

What Is Term Life Insurance?

Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. If you pass away during the term, your beneficiaries receive a death benefit. However, once the term expires, coverage ends unless you renew the policy or convert it to a permanent one.

Pros of Term Life Insurance:

- Affordable premiums: Term life policies are generally much cheaper than whole life insurance, making them a great choice for young families or individuals on a budget.

- Simple and straightforward: The policy is easy to understand—you pay premiums, and if you pass away within the term, your beneficiaries get the payout.

- Flexible coverage periods: You can choose the length of coverage that aligns with your needs, such as covering the years until your mortgage is paid off or your children become financially independent.

Cons of Term Life Insurance:

- Temporary coverage: If you outlive the policy term, you no longer have coverage unless you renew or convert the policy, which can be more expensive.

- No cash value: Unlike whole life insurance, term life policies do not accumulate any savings or investment value.

What Is Whole Life Insurance?

Whole life insurance is a type of permanent life insurance that provides lifelong coverage as long as you pay the premiums. It also includes a cash value component that grows over time, which you can borrow against or withdraw under certain conditions.

Pros of Whole Life Insurance:

- Lifelong coverage: Your policy remains active for your entire life, ensuring that your beneficiaries receive a payout no matter when you pass away.

- Cash value accumulation: Part of your premiums go into a cash value account that grows over time and can be accessed if needed.

- Fixed premiums: Your premium payments remain the same for the life of the policy, making it easier to budget.

Cons of Whole Life Insurance:

- Higher premiums: Whole life insurance is significantly more expensive than term life, often costing five to ten times more for the same death benefit amount.

- Complex structure: The cash value component and investment aspect can be confusing, and returns may not be as high as other investment options.

- Less flexibility: If you need coverage only for a certain period, you may end up overpaying for lifelong coverage you don’t necessarily need.

Which One Is Right for You?

Choosing between term and whole life-insurance depends on your financial situation, goals, and coverage needs. Here’s a quick guide to help you decide:

- Choose term life if: You need affordable coverage for a specific period, such as paying off a mortgage or supporting young children until they become financially independent.

- Choose whole life if: You want permanent coverage with a savings component, or if you’re looking for a way to pass on wealth to your heirs with guaranteed benefits.

Final Thoughts

Both life and tern insurance have their advantages and drawbacks. If budget is a concern and you only need coverage for a certain period, term life-insurance is a practical choice. If you’re looking for long-term financial planning and don’t mind the higher premiums, whole life-insurance might be worth considering. The best decision depends on your unique financial goals and family needs. Consider speaking with a financial advisor to help you make the best choice for your situation.