Scalping vs. Swing Trading: Which Style Suits You Best?

When it comes to trading, there are numerous strategies that traders use to maximize their profits. Two of the most popular styles are scalping and swing trading. Each has its own advantages and drawbacks, making it crucial to determine which one best suits your trading personality and goals. In this post, we’ll break down both trading styles, compare them, and help you decide which one aligns with your trading mindset.

What is Scalping?

Scalping is a short-term trading strategy that focuses on making numerous small profits throughout the day. Scalpers aim to capitalize on minor price movements, entering and exiting trades within seconds to minutes. This strategy requires a high level of discipline, quick decision-making, and a keen eye on the market.

Characteristics of Scalping:

- Very short trade duration – usually a few seconds to a few minutes.

- High-frequency trading – multiple trades executed daily.

- Small profit margins – typically a few pips or cents per trade.

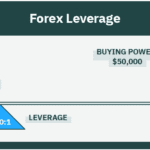

- High leverage – used to amplify gains.

- Requires fast decision-making and execution.

- Relies on technical analysis and indicators like moving averages, RSI, and MACD.

Pros of Scalping:

✔ Quick profits and multiple opportunities throughout the day.

✔ Less exposure to overnight risks or major market moves.

✔ Ideal for traders who enjoy fast-paced environments.

Cons of Scalping:

❌ High stress and intense focus required.

❌ Requires a fast internet connection and low-latency execution.

❌ Transaction fees can add up due to frequent trading.

What is Swing Trading?

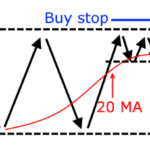

Swing trading is a medium-term trading strategy where traders hold positions for a few days to several weeks, aiming to capture larger price swings. Unlike scalping, swing trading does not require constant monitoring of the market, making it suitable for those who prefer a more relaxed approach.

Characteristics of Swing Trading:

- Trade duration ranges from a few days to weeks.

- Lower frequency of trades compared to scalping.

- Larger profit targets – traders aim to capture significant price swings.

- Uses a mix of technical and fundamental analysis.

- Less reliance on leverage compared to scalping.

Pros of Swing Trading:

✔ Less time-intensive – suitable for those with full-time jobs.

✔ Allows for bigger profit potential per trade.

✔ Lower stress levels compared to scalping.

✔ Lower transaction costs due to fewer trades.

Cons of Swing Trading:

❌ Exposure to overnight and weekend market risks.

❌ Requires patience and ability to hold through temporary drawdowns.

❌ Can miss out on short-term opportunities available to scalpers.

Scalping vs. Swing Trading: Which One is Right for You?

To determine which style suits you best, consider the following factors:

| Factor | Scalping | Swing Trading |

|---|---|---|

| Time Commitment | High – requires full attention during trading hours. | Low – trades can be managed with minimal daily monitoring. |

| Risk Tolerance | High – small mistakes can quickly add up. | Moderate – longer holding periods mean more market exposure. |

| Patience Level | Low – quick in and out trades. | High – requires patience for trends to develop. |

| Technical Skills | Strong – must understand technical indicators and fast executions. | Moderate – uses technical and fundamental analysis. |

| Stress Level | High – requires intense focus and rapid decision-making. | Low to moderate – less pressure due to longer holding times. |

| Profit Potential | Small gains per trade but many trades. | Larger gains per trade but fewer trades. |

Conclusion

Choosing between scalping and swing trading depends on your personality, risk tolerance, and time commitment. If you thrive in a fast-paced environment, enjoy quick decisions, and can handle high levels of stress, scalping might be the right fit for you. On the other hand, if you prefer a more patient approach with less daily stress and are comfortable holding trades for longer periods, swing trading may be your best choice.

No matter which trading style you choose, risk management and discipline are key to long-term success. Start with a demo account, test both strategies, and refine your approach based on what works best for you.