Long-Term Care Insurance: Who Needs It and How It Works

As we age, the likelihood of needing long-term care increases. Whether due to chronic illness, disability, or the natural aging process, many people require assistance with daily activities such as bathing, dressing, or eating. Long-term care insurance (LTCI) is designed to help cover the costs of these services, which can otherwise be financially overwhelming. In this post, we’ll explore who needs long-term care insurance and how it works.

Who Needs Long-Term Care Insurance?

Long-term care insurance isn’t just for the elderly. While most policyholders are seniors, younger individuals with chronic conditions or disabilities may also benefit from coverage. Here are some groups who should consider LTCI:

- Individuals with a Family History of Chronic Illness – If conditions like Alzheimer’s, Parkinson’s, or other degenerative diseases run in your family, LTCI can help mitigate future financial burdens.

- People Without a Strong Family Support System – If you don’t have family members who can provide care, you may need professional assistance, which can be costly.

- Those with Significant Assets to Protect – If you have savings, investments, or property that you’d like to preserve for your heirs, LTCI can prevent these assets from being depleted by long-term care expenses.

- Individuals Planning for Retirement – Including long-term care insurance in your retirement strategy ensures you have the financial means to afford quality care if needed.

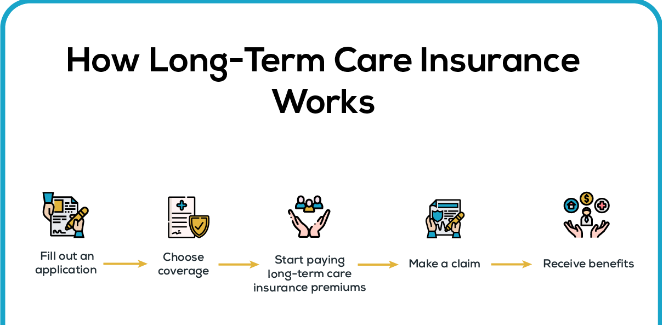

How Does Long-Term Care Insurance Work?

Long-term care insurance policies vary, but they generally cover costs related to home care, assisted living, nursing homes, and adult day care services. Here’s how LTCI typically functions:

- Purchasing a Policy – Premiums are based on factors like age, health, coverage amount, and optional benefits. It’s often more affordable to buy a policy at a younger age when health conditions are more favorable.

- Benefit Triggers – Coverage kicks in when the policyholder can no longer perform a certain number of “activities of daily living” (ADLs), such as dressing, eating, or toileting, or if they suffer from cognitive impairment.

- Elimination Period – Many policies have a waiting period (typically 30-90 days) before benefits begin. During this time, policyholders must cover costs out of pocket.

- Coverage Limits – Policies may have daily, monthly, or lifetime benefit limits. Some policies pay a fixed daily amount, while others reimburse actual costs up to a set limit.

- Types of Care Covered – LTCI may pay for in-home care, assisted living facilities, nursing homes, hospice care, and respite care, depending on the policy’s terms.

Is Long-Term Care Insurance Worth It?

The decision to purchase LTCI depends on personal financial circumstances, health status, and family considerations. While long-term care can be expensive—costing thousands of dollars per month—having insurance can provide financial security and peace of mind.

If you’re considering LTCI, it’s wise to compare policies, understand exclusions, and speak with a financial advisor to determine what’s best for your needs.

Final Thoughts

Long-term care insurance is a valuable tool for safeguarding your financial future and ensuring you receive quality care when needed. By planning ahead, you can protect your assets and relieve your loved ones of financial and caregiving burdens. If you think LTCI might be right for you, start exploring options early to secure the best rates and coverage.