Life Insurance Riders: What Are They and Do You Need Them?

When purchasing a life insurance policy, many people focus on the basics—how much coverage they need and what type of policy to choose. However, one often-overlooked aspect of life insurance is the availability of riders. These add-ons can enhance your policy by providing additional benefits tailored to your specific needs. But what exactly are life insurance riders, and do you really need them? Let’s break it down.

What Are Life Insurance Riders?

Life insurance riders are optional provisions that you can add to your standard policy for an extra cost. They allow you to customize your coverage, ensuring that your policy aligns more closely with your financial goals and personal circumstances. Riders can provide extra protection, offer financial flexibility, or address specific concerns that a standard policy may not cover.

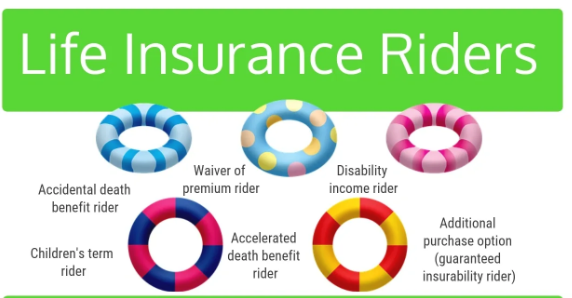

Common Types of Life Insurance Riders

Here are some of the most popular life insurance riders and how they work:

1. Accelerated Death Benefit Rider

This rider allows you to access a portion of your death benefit if you’re diagnosed with a terminal illness. It can help cover medical expenses and other costs, reducing financial stress during a difficult time.

2. Waiver of Premium Rider

If you become disabled and are unable to work, this rider waives your policy premiums so your coverage remains in place without the financial burden of monthly payments.

3. Accidental Death Benefit Rider

This rider provides an additional payout if the policyholder dies due to an accident. It’s particularly useful for individuals in high-risk occupations or those who want extra protection against unforeseen incidents.

4. Child Term Rider

A child term rider provides life insurance coverage for your children under a single policy. It can help with funeral expenses in the unfortunate event of a child’s passing and may be converted into a permanent policy later.

5. Long-Term Care Rider

This rider helps cover the costs of long-term care, such as nursing home or assisted living expenses, by allowing you to use part of your death benefit while you’re still alive.

6. Return of Premium Rider

If you outlive your policy term, this rider refunds the premiums you’ve paid, making it a potential option for those who want to recoup their investment in life insurance.

Do You Need Life Insurance Riders?

While life insurance riders offer valuable benefits, they are not necessary for everyone. Here are some factors to consider when deciding whether to add riders to your policy:

- Your Financial Situation: If you have enough savings or separate insurance to cover medical expenses, disability, or long-term care, you may not need additional riders.

- Your Risk Factors: If you have a high-risk job or a family history of critical illnesses, certain riders (like the waiver of premium or long-term care rider) could be beneficial.

- Your Budget: Riders come at an additional cost. If adding them significantly increases your premiums, it may be worth evaluating if the benefits justify the expense.

- Your Family’s Needs: If your family relies on your income, a waiver of premium or an accidental death benefit rider might provide extra security.

Final Thoughts

Life insurance riders can enhance your coverage, offering financial protection beyond a standard policy. However, they should be selected carefully based on your unique needs and financial situation. Before adding a rider, weigh the costs against the benefits and consult with a financial advisor or insurance professional to determine the best options for you.

Ultimately, life insurance is about peace of mind—ensuring that you and your loved ones are protected, no matter what life throws your way.