Investment Myths Debunked: Separating Facts from Fiction

Investing can be a powerful way to build wealth, yet many people hesitate due to myths and misconceptions. Misinformation can create unnecessary fear, preventing individuals from making informed financial decisions. In this post, we’ll debunk some of the most common investment myths and uncover the real facts.

Investment Myths 1: Investing is Only for the Wealthy

Fact: Anyone Can Start Investing with Small Amounts

One of the most persistent myths is that investing requires a lot of money. The truth is, you don’t need to be rich to invest. Many brokerage firms and financial apps allow you to start with as little as $10. Thanks to fractional shares, you can own a portion of high-priced stocks without buying a whole share.

Investment Myths 2: Investing is Just Like Gambling

Fact: Investing is a Strategic Wealth-Building Tool

Gambling is based on luck, whereas investing is based on research, strategy, and long-term growth. While there are risks involved, a well-diversified portfolio and informed decisions can significantly reduce those risks. Unlike gambling, where the odds are stacked against you, investing rewards patience and knowledge.

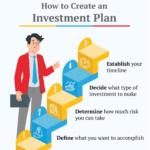

Investment Myths 3: You Need to Be an Expert to Invest

Fact: Anyone Can Learn to Invest with Basic Knowledge

You don’t need a finance degree to start investing. With the rise of educational resources, investing platforms, and robo-advisors, even beginners can make informed choices. Simple strategies, such as investing in index funds or ETFs, can help you grow wealth without requiring constant market analysis.

Myth 4: The Stock Market is Too Risky

Fact: Long-Term Investing Reduces Risk

While the stock market does experience ups and downs, historical data shows that it has consistently trended upwards over the long run. Diversification, investing in solid companies, and staying invested for the long term can help minimize risk and maximize potential returns.

Myth 5: You Should Wait for the ‘Perfect’ Time to Invest

Fact: Time in the Market is More Important than Timing the Market

Trying to predict the market’s highs and lows is nearly impossible. Instead of waiting for the “perfect” time, it’s better to start investing as soon as possible. The longer your money is invested, the more you can benefit from compound interest and market growth.

Myth 6: All Debt Should Be Paid Off Before Investing

Fact: Investing and Paying Off Debt Can Be Balanced

While paying off high-interest debt should be a priority, it doesn’t mean you have to delay investing completely. If you have manageable debt (like a low-interest mortgage or student loan), you can still contribute to retirement accounts or take advantage of employer-matching contributions.

Final Thoughts

Investing doesn’t have to be intimidating, and debunking these myths can help you take control of your financial future. By focusing on facts and staying informed, you can build a strong investment strategy that works for you.

Are you ready to start investing? Share your thoughts or questions in the comments!