Introduction to Loans: What Are They and How Do They Work?

Loan is crucial in personal and business finance, allowing individuals and organizations to access funds for various needs. Whether you’re planning to buy a house, start a business, or cover emergency expenses, understanding how it works can help you make informed financial decisions.

What Is a Loan?

A loan is a sum of money borrowed from a lender, which must be repaid over time with interest. Lenders can be banks, credit unions, online lenders, or even private individuals. They are often used for significant purchases, investments, or financial emergencies.

When borrowing, the borrower agrees to repay the principal amount (the original sum borrowed) along with interest, which is the cost of borrowing. Loan terms, including interest rates, repayment schedules, and fees, vary depending on the lender and the borrower’s creditworthiness.

Types of Loans

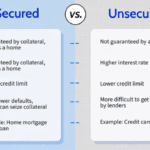

1. Secured Loan

These loans require collateral—an asset like a house or car—that the lender can claim if the borrower defaults on payments. Examples include:

- Mortgages: Loans used to purchase a home, with the house serving as collateral.

- Auto Loans: borrowing to buy a vehicle, where the car itself is collateral.

- Home Equity Loans: Loans borrowed against the equity in a home.

2. Unsecured Loan

Unlike secured, unsecured loans do not require collateral. Instead, lenders assess a borrower’s credit history and income to determine eligibility. Examples include:

- Personal borrowing: Used for various purposes such as medical expenses, travel, or home improvements.

- Credit Cards: A form of revolving credit that allows borrowing up to a set limit.

- Student Loans: Designed to help students finance education costs.

3. Business Loan

These borrowings are specifically designed for businesses to fund operations, expansion, or equipment purchases. They can be secured or unsecured, depending on the lender’s requirements.

4. Payday Loan

Short-term, high-interest loans designed for emergency expenses. They often have quick approval times but come with significant financial risks due to their high fees.

How Does Borrowing Work?

Borrowing operates on the principle of lending and repayment. The process typically involves the following steps:

- Application: The borrower submits a loan application with necessary documents, including proof of income and credit history.

- Approval & Terms: The lender evaluates the borrower’s creditworthiness and offers loan terms, including interest rate and repayment period.

- Disbursement: Once approved, the loan amount is disbursed to the borrower.

- Repayment: The borrower repays the loan in installments (monthly, bi-weekly, or otherwise) until the debt is cleared.

Key Factors to Consider When Taking a Loan

Before applying for a loan, consider the following:

- Interest Rates: The cost of borrowing, which can be fixed or variable.

- Loan Term: The duration over which the loan must be repaid.

- Fees & Charges: Additional costs like processing fees, late payment fees, or prepayment penalties.

- Credit Score: A strong credit score can help secure better loan terms.