How to Start Investing with Little Money

Many people believe that investing is only for the wealthy, but that’s a myth. You don’t need a fortune to start building wealth—small, consistent investments can grow significantly over time. With the right approach, anyone can start investing with just a little money. In this post, we’ll cover simple and effective ways to begin investing, even on a tight budget.

1. Understand the Power of Compound Interest

One of the biggest reasons to start investing early, even with a small amount, is compound interest. This means that your earnings generate additional earnings over time. Even small, consistent contributions can grow into substantial wealth over the years.

💡 Example: If you invest just $50 per month and earn an average annual return of 8%, you could have over $30,000 in 20 years.

2. Set Clear Financial Goals

Before you start investing, define your goals:

-

Are you saving for retirement?

-

Do you want to buy a home?

-

Are you investing for long-term wealth?

Your goals will determine how much risk you can take and the best investment options for you.

3. Start with Low-Cost Investment Options

Even with a small amount of money, you have access to several great investment options:

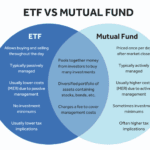

A. Exchange-Traded Funds (ETFs) & Index Funds

-

ETFs and index funds allow you to invest in a diversified portfolio of stocks with minimal money.

-

Many platforms let you invest with as little as $1.

-

They have low fees and provide steady long-term growth.

✅ Best for: Beginners who want diversification without picking individual stocks.

B. Fractional Shares

-

Some brokers allow you to buy fractional shares of expensive stocks (e.g., Apple, Amazon) with just a few dollars.

-

This makes it easier to invest in high-quality companies even if you have a limited budget.

✅ Best for: Those who want to invest in individual stocks without needing a lot of capital.

C. Robo-Advisors

-

Robo-advisors are automated investment platforms that manage your money for you.

-

They use algorithms to build a diversified portfolio based on your risk tolerance and goals.

-

Some allow you to start with as little as $5 or $10.

✅ Best for: People who want a hands-off investing approach.

4. Use Micro-Investing Apps

If you’re worried about having little money, micro-investing apps can help. These apps round up your everyday purchases and invest the spare change.

Popular Micro-Investing Apps:

-

Acorns – Rounds up your spare change and invests it.

-

Stash – Lets you invest in ETFs and stocks with as little as $1.

-

Robinhood – Offers fractional shares and commission-free investing.

✅ Best for: Those who want to start with very small amounts and invest passively.

5. Take Advantage of Employer-Sponsored Retirement Accounts

If your job offers a 401(k) or similar retirement plan, start contributing—even if it’s a small amount.

-

Many employers offer matching contributions (free money!).

-

Contributions are tax-advantaged, which helps your money grow faster.

-

You can start with just 1-2% of your salary and increase it over time.

✅ Best for: Employees who want to build wealth for retirement.

6. Invest Consistently (Even If It’s Small)

The key to growing wealth is consistency. You don’t need to invest a lot at once—just start!

💰 Example Strategies:

-

Invest $10 per week instead of buying fast food.

-

Use your tax refund or bonus money to start investing.

-

Automate your investments so money is invested before you spend it.

7. Avoid Common Beginner Mistakes

-

❌ Don’t try to time the market – Invest regularly instead of waiting for the “perfect” time.

-

❌ Don’t invest money you can’t afford to lose – Only invest extra money after covering essential expenses.

-

❌ Don’t put all your money in one stock – Diversify with ETFs or multiple assets.

8. Keep Learning & Improving

Investing is a lifelong journey. Stay informed by:

📚 Reading books (e.g., The Simple Path to Wealth by JL Collins).

🎧 Listening to podcasts about investing.

📊 Following financial news and expert advice.

Final Thoughts: on how to Start Investing

You don’t need thousands of dollars to start investing. Even $5 or $10 per week can make a difference over time. The most important step is to get started today. Small, consistent investments will help you build wealth and reach your financial goals.