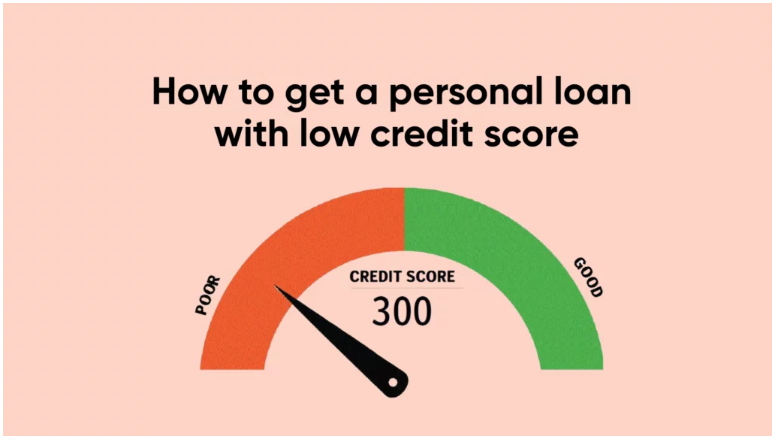

How to Qualify for a Personal Loan with a Low Credit Score

A low credit score can make qualifying for a personal loan more challenging, but it’s not impossible. Lenders consider multiple factors beyond your credit score, so if you need a loan but have less-than-perfect credit, there are still ways to improve your chances of approval. Here’s how:

1. Understand Your Credit Situation

Before applying, check your credit score and review your credit report for errors. You can obtain a free credit report from major credit bureaus once a year. Identifying and disputing inaccuracies can potentially improve your score and make you a more attractive borrower.

2. Look for Lenders Who Work with Low Credit Scores

Not all lenders require excellent credit. Some online lenders, credit unions, and community banks specialize in loans for borrowers with lower credit scores. Research lenders that have more flexible requirements and compare their terms.

3. Consider a Secured Loan

A secured personal loan requires collateral, such as a car, savings account, or other assets. Because collateral reduces the lender’s risk, you may qualify for better terms even with a low credit score. However, be aware that failure to repay the loan could result in the loss of your collateral.

4. Apply with a Co-Signer

Having a co-signer with a strong credit history can significantly increase your chances of approval. The co-signer agrees to take responsibility for the loan if you default, giving the lender more confidence in lending to you.

5. Show Proof of Income and Financial Stability

Lenders look at your ability to repay the loan, not just your credit score. Providing proof of stable income, such as pay stubs, tax returns, or bank statements, can help reassure lenders that you can make timely payments.

6. Reduce Your Debt-to-Income Ratio

Your debt-to-income (DTI) ratio measures how much of your monthly income goes toward debt payments. A high DTI can make lenders hesitant to approve your loan. Paying down existing debt before applying can improve your chances of approval.

7. Start with a Prequalification Check

Many lenders offer prequalification, which allows you to see potential loan offers without affecting your credit score. This helps you compare rates and terms before officially applying.

8. Be Prepared for Higher Interest Rates

With a low credit score, you may face higher interest rates. Make sure you understand the total cost of the loan, including fees and interest, before accepting any offers. Borrow only what you need and can afford to repay.

9. Consider Alternative Lending Options

If traditional lenders reject your application, consider alternative options such as credit-builder loans, payday alternative loans (PALs) from credit unions, or loans from peer-to-peer lending platforms.

10. Work on Improving Your Credit

If you do not need a loan urgently, taking a few months to improve your credit score can help you secure better loan terms. Paying bills on time, reducing credit card balances, and avoiding new hard inquiries can contribute to a higher score.

Final Thoughts

While qualifying for a personal loan with a low credit score is more challenging, it’s possible with the right strategy. By exploring lenders that accommodate lower scores, considering secured loans or co-signers, and demonstrating financial stability, you can increase your chances of approval. Additionally, working to improve your credit over time will open up better borrowing opportunities in the future.