If you’re starting a new business, one of the initial steps to consider is opening a business bank account.

This guide will walk you through everything you need to know about opening a business bank account in the UK. We’ll cover the different types of accounts, associated costs, and provide a step-by-step guide to the process.

Additionally, we’ll highlight some of the best business bank accounts in the UK, including Revolut Business account.

**Does My Business Need a Business Bank Account?**

Not every type of business requires a dedicated business bank account, though there are advantages to having one, which we’ll explore shortly.

However, if you run a registered limited company in the UK, a separate business account is mandatory. A limited company is legally distinct from its owner, necessitating a separate bank account.

You do not need a business bank account if you are:

– A sole trader

– A freelancer

– Engaged in gig work.

**What Are the Benefits of Having a Business Bank Account?**

A primary advantage of having a dedicated business bank account is the ability to keep your personal and business finances separate. Additionally, personal accounts may have restrictions on certain transactions, so upgrading to a business account can provide more options and support business growth.

Other benefits of opening a business bank account include:

– Reducing administrative time when submitting tax returns to HMRC

– Building a credit rating for your business

– Accessing business tools, resources, support, finance, and credit

– Enhancing your business’s professional image to clients and customers.

**UK Business Bank Account for Non-Residents**

There are no laws or restrictions preventing non-residents from opening a business bank account in the UK. However, the process might not be as straightforward as it is for UK residents.

Many banks require company directors to reside in the UK when applying due to strict anti-money laundering regulations, which can make it challenging for overseas business owners to open bank accounts.

Your best chances are with major UK banks like NatWest or HSBC, which have an international presence.

Alternatively, you can consider digital providers such as Revolut or Tide. These mobile banks require the business to have a physical presence in the UK or be registered with the UK’s Companies House, but you don’t need to live in the UK to be eligible.

Another option is opening an international account that accepts GBP and other currencies your business trades in, such as Revolut Business Bank Account.

Learn More About Revolut Business Bank Account

**Can I Open a Business Bank Account in the UK with a Foreign Corporate Entity?**

Opening a bank account in the UK for a foreign corporate entity can be challenging. However, if you already have an account with a large global bank in your home country, they may assist you in setting up an account with their UK branch.

Start by contacting some of the UK’s major banks, such as HSBC, Lloyds, Barclays, and NatWest. These banks are more likely to offer international accounts and specialist UK business bank accounts for non-residents.

For a more flexible and quicker option, you might consider a Revolut Business Bank account.

**Opening a Business Bank Account in the UK – Types of Accounts**

There are various business bank accounts available in the UK, depending on the bank you choose. Most accounts fall into the following categories:

– **Startup Business Bank Accounts**: Designed for new or small businesses, freelancers, and sole traders. Some offer a fee-free period and business support tools to help you launch your venture.

– **Business Bank Accounts for Growing and Established Companies**: Often categorized by turnover, these accounts have limits and charges based on the size of your business.

– **Community and Not-for-Profit Accounts**: For charities, social enterprises, clubs, schools, or other non-profits, most UK banks offer dedicated everyday accounts with low or no fees.

– **Multi-Currency Accounts**: Many banks provide these accounts for businesses that trade overseas.

**Can You Open a Business Bank Account in the UK with a Bad Credit History?**

Opening a business bank account in the UK with a bad credit history can be challenging, but it’s not impossible. If you present a detailed business plan, you may be able to demonstrate your suitability by arranging a meeting with your chosen bank.

While most banks conduct credit checks, some digital banking solutions like ANNA and Tide only perform ‘soft’ credit and identity checks to comply with UK anti-money laundering regulations. This approach might increase your chances of approval, even with a poor credit history.

Additionally, some UK high street banks offer ‘basic’ bank accounts specifically designed for applicants with bad credit scores.

**Best Business Bank Accounts in the UK**

Ready to open your UK business bank account? Here are some top options from both high street and digital banks, based on an independent 2021 survey by business insight consultancy BVA BDRC:

Starling Bank Business Current Account

Voted the best for service quality, online banking, and overdraft services, Starling Bank is a digital-only fintech solution used by over 450,000 UK businesses.

The Starling Business Current Account is FSCS regulated and offers 24/7 customer support via app, email, or phone. It’s free to use with no monthly fees, though you can customize it with paid-for extra features like invoice creation or HMRC tax calculation.

This free digital-only account is suitable for sole traders, Limited Companies, and LLPs. When you open a Starling Business account, it includes the following standard features:

– A Mastercard debit card

– Multi-director access

– Integration with accounting tools

– Receipt capture for tracking expenses.

Metro Bank Business Bank Account

Rated best for branch service, particularly outside regular working hours, Metro Bank provides a Business Bank Account tailored for sole traders and limited companies with an annual turnover of less than £2 million.

Key features of the Metro Bank Business Bank Account include:

– Straightforward pricing

– 24/7 customer support

– A convenient mobile app for managing finances on the go

– A dedicated local business manager

– Smart business and accounting tools

– A business debit card

Santander Business Current Account

The Santander Business Current Account is highly recommended for startups, offering 18 months of fee-free everyday banking.

Key features include:

– Arranged overdraft

– Online and mobile banking

– Business debit card

Currently, Santander is only accepting applications from existing customers who wish to open a new business account.

Barclays Business Current Account

Barclays provides a variety of business current accounts designed to meet the needs of companies from startups to larger, established businesses.

For businesses with a turnover up to £400k, the Barclays Business Bank Account offers straightforward everyday banking solutions. You can choose from two pricing plans and receive comprehensive support from a UK-based Business Direct team.

Opening a business account with Barclays includes the following features:

– Free invoicing and accounting software

– Online and mobile banking app

– Access to support for payments, business expansion, and cash flow management

### How to Open a Business Account Online

Most banks allow you to apply for a business account online, either by starting a new application or using the Current Account Switch Service, which ensures the switch is completed within 7 days. However, some banks might require an in-person visit to verify your identity or provide additional information.

When applying for a business account online, you will typically need to provide:

– Information about all partners, directors, or members of the business, including recent home addresses

– Full details of your business, including contact information and trading/registration addresses in the UK

– Details of your company’s cash flow or financial forecasts

– Your registered company number with Companies House (for limited companies only)

You must be at least 18 years old and either the owner or a director of the business to apply for a UK business account.

Before you start the application process, check the specific requirements of your chosen bank. Visit the bank’s website for details on required documentation or contact the bank directly. For information on the Current Account Switch Service, you can find more details [here].

### How Long Does It Take to Open a Business Bank Account?

Using the Current Account Switch Service, you can open a business bank account in as little as 7 days. However, without this service, the process may take anywhere from 4 weeks to 3 months.¹⁰

### How Much Does It Cost to Open a Business Account?

Opening a business bank account itself is generally free, but there are often monthly fees once the account is active. If you opt for a startup account, you might enjoy a fee-free period initially. It’s crucial to carefully review and compare the fees associated with different business bank accounts before starting your application.

To provide an overview of the costs associated with UK business bank accounts, let’s compare the fees of some popular providers, including Revolut Business Bank Account.

| Bank | Monthly fee | Send/receive money locally | Receive money from abroad | Send money abroad |

|---|---|---|---|---|

| Starling bank | Free | Free | 0.4% + local fees + £5.50 for SWIFT payments | Free for GBP, 2% for EUR |

| Metro bank | £6 – for balances below £6,000 | £0.30 each (30 free a month for balances of £6,000+) | 1% | £0.20 for SEPA payments or £25 for SWIFT payments |

| Santander | £7.50 | Free | Free | Free for SEPA payments or £25 for SWIFT payments |

| Barclays | £8 – £8.50 | £0 – £0.35 | £6 | £0.35 for SEPA payments or £15 for other international payments |

| Revolut Business | Free | Free | Up to 30 currencies | From 0.41% (varies by currency) |

Open A Revolut Business Bank Account

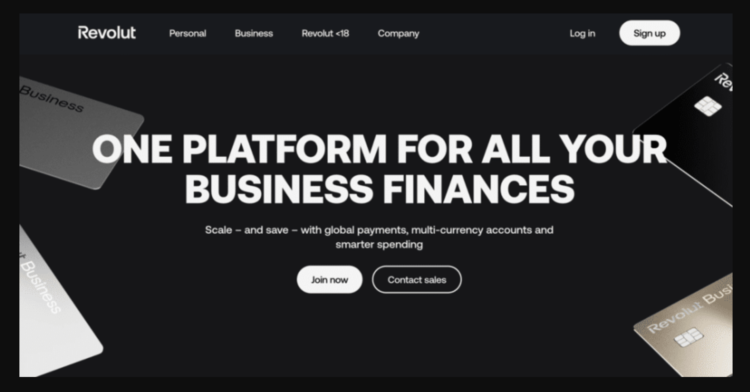

**Who is Revolut?**

Revolut is a fintech company founded in 2015 by Nikolay Storonsky and Vlad Yatsenko, headquartered in London and regulated by the Bank of Lithuania.

Revolut offers a range of services including current accounts, debit cards, stock trading, currency exchange, and peer-to-peer payments. However, it does not have UK bank status, which impacts its obligations for compensation related to authorized push payment fraud and fund protection in the UK.

The company has experienced rapid growth since its inception, expanding into the US and Japanese markets and increasing its workforce from 1,500 to 6,000 by 2020. It achieved a valuation of £4.2 billion in 2020, making it the UK’s most valuable fintech company.

By 2021, Revolut’s valuation surged to $33 billion after a successful funding round, solidifying its position as the UK’s most valuable tech startup.

As of 2023, Revolut serves over 28 million customers worldwide and offers services including crypto trading, currency exchange, and staking for proof-of-stake cryptocurrencies.

If your business is engaging with the global market or needs to pay vendors and suppliers overseas, a multi-currency business account could be advantageous.

Revolut Business provides:

– Free set up fee

– No foreign exchange mark-up—always receive the mid-market exchange rate

– Fast, entirely online setup

– Capability to receive international payments

– Ability to hold funds in multiple currencies

– Opportunity to earn interest on the funds you maintain

**Free Plan:** Perfect for small startups or individual entrepreneurs who need basic digital banking tools.

**Grow Plan:** Ideal for small to medium-sized businesses aiming for growth, providing additional free transactions, bulk payment options, and API access.

**Scale Plan:** Crafted for larger businesses needing extensive banking services, including higher limits for free international payments, advanced team member permissions, and enhanced API capabilities.

**Enterprise Plan:** Customized for large corporations requiring a bespoke banking solution, featuring all premium features, unlimited free transactions, and dedicated support.

**International Transfers**

Revolut provides a clear and efficient platform for currency conversion and international transfers, supporting 29 currencies with no hidden fees.

You can hold, send, and exchange funds through various methods, including bank transfers, card payments, and soon, digital wallets. All fees are transparently displayed upfront.

The platform offers competitive currency exchange rates, illustrated with an example where £1,000 converts to €1,150.61 at a rate of £1 = €1.1506. Note that this rate applies to card transactions and may vary for other types of transfers.

Revolut’s features, such as real-time foreign exchange rate tracking and the ability to set limits and stop orders, give you enhanced control over your transactions.

This service streamlines managing multiple currencies and executing transfers, which can be easily done from a smartphone or computer, with broad global coverage ensuring convenient money management worldwide.

Revolut Business Account

| Feature/Benefit | Basic (£0/month) |

Grow (From £19/month) |

Scale (From £79/month) |

Enterprise (Custom) |

|---|---|---|---|---|

| No-fee international transfers |

0 | 5 | 25 | Custom |

| No-fee local transfers | 5 | 100 | 1,000 | Custom |

| SWIFT account details | ✓ | ✓ | ✓ | ✓ |

| Currency exchange at interbank rate (before fees) |

£1,000 | £10,000 | £50,000 | Custom |

| Plastic company cards | ✓ | ✓ | ✓ | ✓ |

| Exclusive Revolut metal company card. Fees Apply |

✕ | 1 free | 2 free | Custom |

| Payment acceptance fees | From 0.8% + £0.02 |

From 0.8% + £0.02 |

From 0.8% + £0.02 |

Custom |

| Personal Account Management |

✕ | ✕ | ✕ | ✓ |

| Business API | ✕ | ✓ | ✓ | ✓ |

| Bulk Payments | ✕ | ✓ | ✓ | ✓ |

| Limit and stop orders | ✕ | ✓ | ✓ | ✓ |

| Daily interest on GBP savings |

✕ | 2.25% AER up to £0.5m |

2.75% AER up to £1m |

3.51% AER up to £2m |

| Rewards scheme | ✕ | ✓ | ✓ | ✓ |

To get started with Revolut’s Business Banking, Click Here

**Security: Is Revolut Safe?**

Revolut implements various security measures to protect customer funds and personal information.

To provide a clearer picture, let’s compare Revolut’s security features with those used by traditional banks and Electronic Money Institutions (EMIs) in the following table.

| Security Measures | Revolut Implementation |

|---|---|

| Physical Security Measures | |

| Bank Vaults | ✕ |

| Secure Transportation | ✕ |

| Access Controls | ✕ |

| Surveillance Systems | ✕ |

| Security Guards | ✕ |

| Digital Security Measures | |

| Encryption | ✓ |

| Firewalls | ✓ |

| SSL Certificates | ✓ |

| Two-Factor Authentication (2FA) | ✓ |

| Anti-Malware Software | ✓ |

| Fraud Detection Systems | ✓ |

| Data Masking | ✕ |

| Regular Software Updates | ✓ |

| Disposable Virtual Cards | ✓ |

| AI-based Scam Detection | ✓ |

| Location-Based Security | ✓ |

| Virtual Prepaid Cards | ✓ |

| Secure Customer Authentication (SCA) | ✓ |

| Dedicated IBANs for Enhanced Transaction Tracking | ✓ |

| Anti-Phishing Tools | ✓ |

| Operational Security Measures | |

| Strict Regulatory Compliance | FCA (900562), FCA (780586), CySEC (001/22), Bank of Lithuania (304580906) |

| Employee Training | ✓ |

| Audit Trails | ✓ |

| Risk Assessment and Management | ✓ |

| Client Education | ✓ |

| Incident Response Plans | ✓ |

| Advanced Fraud Protection and Custom Card Controls | ✓ |

| EMI Specific Measures | |

| Digital-Only Infrastructure | ✓ |

| Cloud Security | ✓ |

| API Security | ✓ |

| Biometric Security | ✓ |

| Robo-Advisor for Investing | ✓ |

Revolut employs regulated banks to safeguard user funds, ensuring that your money is protected by institutions regulated by the Financial Conduct Authority (FCA).

Additionally, Revolut takes extensive measures to secure card data, whether it is stored or processed, ensuring that your card details are always protected.

To enhance account security, Revolut monitors for unusual transactions and requires additional verification steps, helping to prevent potential fraud or theft.

The platform also offers extra security features, such as single-use cards for secure online purchases and reliable methods for adding funds to your account.

Moreover, private keys for cryptocurrency transactions remain offline, minimizing the risk of interception or theft.

While no system can guarantee absolute security, Revolut’s comprehensive protective measures and adherence to regulations contribute significantly to the platform’s overall safety.

Customer Support

Revolut provides several customer support options, including 24/7 in-app live chat, email assistance, and an automated phone line for urgent issues like card blocking.

Overall, customer feedback on Revolut’s support is mixed. Many users value the convenience of the 24/7 live chat feature, which is the primary contact method for support.

Premium and Metal account holders receive priority support, often resulting in faster response times and resolutions.

However, some users, particularly those on basic or free plans, have reported challenges in obtaining timely assistance when problems occur.

That’s everything you need to know about opening a business bank account in the UK.

With your paperwork organized and the necessary details prepared, the process should be fairly straightforward. Best of luck!