How to Create a Budget That Actually Works

Creating a budget sounds simple—track your income, subtract your expenses, and stick to the plan. But in reality, many people struggle to maintain a budget that truly works for them. Unexpected costs, impulse spending, and unrealistic financial goals can all derail a budget.

The key to success is building a budget that is realistic, flexible, and sustainable. In this post, we’ll walk you through the step-by-step process on how to create a budget that actually works.

Step 1: Set Clear Financial Goals

Before you start crunching numbers, ask yourself:

- What do I want to achieve financially? (Save for a house, pay off debt, travel more?)

- What’s my timeline? (Short-term vs. long-term goals)

- How much can I realistically save each month?

Having clear goals will motivate you to stick to your budget and make smart financial decisions.

Step 2: Track Your Income and Expenses

To create an effective budget, you need a clear picture of your income and spending habits.

- Track your income: Include your salary, freelance work, side hustles, or passive income.

- Track your expenses: Break them into categories like rent, groceries, entertainment, transportation, and savings.

📌 Pro Tip: Use apps like Mint, YNAB (You Need a Budget), or Excel spreadsheets to simplify tracking.

Step 3: Categorize and Prioritize Your Expenses

Divide your expenses into three main categories:

1. Fixed Expenses (Essentials)

- Rent/mortgage

- Utilities (electricity, water, internet)

- Loan payments (student loans, car loans)

- Insurance (health, car, home)

2. Variable Expenses (Day-to-Day Spending)

- Groceries

- Transportation

- Dining out

- Entertainment

- Shopping

3. Savings and Investments

- Emergency fund

- Retirement contributions

- Investments (stocks, real estate, etc.)

📌 Pro Tip: Aim to allocate at least 20% of your income toward savings and debt repayment.

Step 4: Choose a Budgeting Method

There’s no one-size-fits-all approach to budgeting. Choose a method that fits your lifestyle:

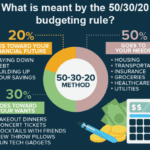

1. The 50/30/20 Rule (Best for beginners)

- 50% Needs (rent, bills, groceries)

- 30% Wants (shopping, dining, entertainment)

- 20% Savings & Debt Repayment

2. Zero-Based Budgeting (Best for detail-oriented planners)

- Every dollar is assigned a job.

- Income – Expenses = $0 (every dollar has a purpose).

- Great for tracking and eliminating wasteful spending.

3. The Envelope System (Best for cash spenders)

- Use envelopes with specific cash amounts for different spending categories.

- Once the envelope is empty, no more spending in that category!

Choose a system that matches your financial goals and spending habits.

Step 5: Cut Unnecessary Expenses

Look for areas where you can reduce spending without sacrificing your quality of life.

✅ Cancel unused subscriptions (gym memberships, streaming services).

✅ Limit impulse purchases by using a 24-hour rule before buying non-essentials.

✅ Cook at home more often instead of eating out.

✅ Shop smarter by using cashback apps and looking for discounts.

Even small changes can lead to big savings over time!

Step 6: Build an Emergency Fund

Life is unpredictable. Having 3–6 months’ worth of expenses saved will protect you from unexpected financial stress.

💡 Start small: Set aside $500–$1,000 and gradually increase it.

💡 Keep it separate: Open a high-yield savings account for emergencies only.

Step 7: Review and Adjust Your Budget Regularly

A budget is not set in stone. Life changes—your budget should too!

📅 Set a reminder to review your budget monthly.

📉 Adjust categories if you’re overspending or underspending.

🎯 Refocus on goals if you lose motivation.

Flexibility is key to making your budget sustainable long-term.

Final Thoughts on How to Create a Budget: Make Your Budget Work for You

A budget should empower you, not feel restrictive. By setting realistic goals, tracking expenses, and adjusting as needed, you can create a budget that helps you achieve financial freedom.