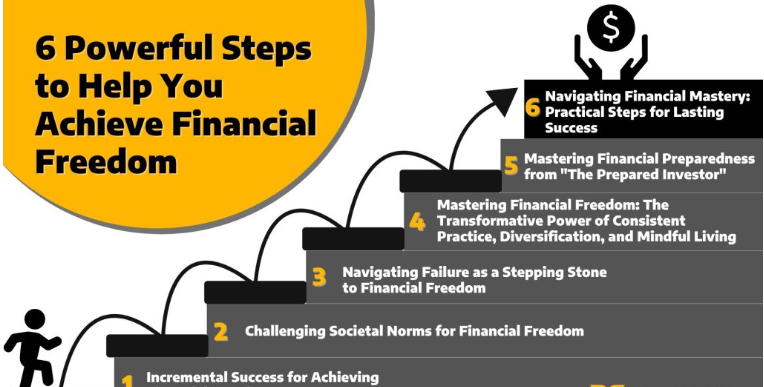

How to Achieve Financial Freedom: Actionable Steps to Success

Financial freedom means having enough wealth and passive income to cover your living expenses, allowing you to live life on your own terms. It’s not about being rich—it’s about controlling your money so you’re not dependent on a paycheck.

The journey to financial freedom requires discipline, smart decisions, and a long-term mindset. Here’s a step-by-step guide to help you build wealth and achieve financial independence.

1. Define What Financial Freedom Means to You

Before starting your journey, clarify your financial goals. Ask yourself:

✅ How much money do I need to live comfortably without working?

✅ Do I want to retire early, travel, or start a business?

✅ What does financial freedom look like for me?

Your goals will guide your saving, investing, and spending strategies.

2. Create a Budget and Stick to It

A budget is your roadmap to financial freedom. It helps you control spending, prioritize savings, and eliminate debt.

How to Build a Simple Budget:

🔹 Track income and expenses using apps like Mint or YNAB.

🔹 Follow the 50/30/20 rule:

-

50% needs (housing, food, bills)

-

30% wants (entertainment, travel)

-

20% savings/investing

🔹 Regularly review and adjust your budget.

3. Build an Emergency Fund

An emergency fund prevents you from relying on credit cards or loans when unexpected expenses arise.

How Much Should You Save?

💰 3-6 months of living expenses in a high-yield savings account.

💰 If self-employed, aim for 6-12 months of expenses.

Start small if necessary—$25-$50 per month adds up over time.

4. Eliminate Debt (Especially High-Interest Debt)

Debt is a major roadblock to financial freedom, especially high-interest debt like credit cards.

Strategies to Pay Off Debt Faster:

✔ Debt Snowball Method – Pay off the smallest debt first for quick wins.

✔ Debt Avalanche Method – Pay off the highest-interest debt first to save money.

✔ Make extra payments whenever possible to reduce interest costs.

Avoid unnecessary loans—if you can’t afford it in cash, reconsider the purchase.

5. Increase Your Income

Boosting your income accelerates your path to financial freedom.

Ways to Increase Earnings:

💡 Ask for a raise – Research industry salaries and negotiate.

💡 Start a side hustle – Freelancing, online business, tutoring, etc.

💡 Invest in skills – Take courses or certifications to qualify for higher-paying jobs.

Use extra income to pay off debt, invest, and grow wealth.

6. Save and Invest Wisely

Saving alone won’t make you financially free—you need to invest to grow your wealth.

Where to Invest:

📈 Stock Market – Invest in index funds (S&P 500, ETFs) for long-term growth.

🏠 Real Estate – Rental properties can provide passive income.

📊 Retirement Accounts – Maximize contributions to 401(k), IRA, or Roth IRA.

📚 Yourself – Education and skills increase your earning potential.

Start investing ASAP to benefit from compound interest.

7. Automate Your Finances

Automating your money helps you stay consistent and avoid bad spending habits.

What to Automate:

✅ Savings & Investments – Set up auto-transfers to savings and investment accounts.

✅ Bill Payments – Avoid late fees by automating recurring expenses.

✅ Debt Payments – Ensure timely payments to reduce interest.

This ensures money goes to financial goals first, not unnecessary spending.

8. Build Multiple Streams of Income

Relying on a single income source is risky. Multiple income streams provide financial security and accelerate wealth-building.

Ideas for Passive Income:

💰 Dividend stocks

🏡 Rental income

📘 Writing e-books or creating online courses

📦 Selling products online

🖥 Affiliate marketing

The more sources of income you have, the faster you can reach financial freedom.

9. Live Below Your Means

Avoid lifestyle inflation—when income rises, many people spend more instead of saving more.

How to Live Below Your Means:

✔ Avoid unnecessary luxury purchases.

✔ Buy quality items that last longer.

✔ Prioritize experiences over material things.

✔ Save and invest raises/bonuses instead of upgrading your lifestyle.

Financial freedom comes not from how much you earn, but how much you keep and invest.

10. Plan for Retirement and Long-Term Wealth

Retirement planning ensures you can sustain financial freedom for life.

Key Steps for Retirement Planning:

✅ Max out 401(k) and IRA contributions.

✅ Estimate how much you’ll need for retirement.

✅ Consider long-term care insurance for medical expenses.

✅ Build passive income sources to cover expenses without relying on a job.

The earlier you start, the easier it is to achieve financial freedom.

11. Protect Your Wealth

Once you build wealth, you need to protect it from unexpected risks.

How to Protect Your Money:

✔ Get insurance – Health, life, disability, and liability insurance.

✔ Create an estate plan – A will and trust ensure your wealth is distributed according to your wishes.

✔ Diversify investments – Don’t keep all your money in one asset class.

Financial freedom isn’t just about earning money—it’s about keeping it safe for the future.

12. Stay Consistent and Be Patient

Achieving financial freedom takes time—it’s a marathon, not a sprint.

How to Stay on Track:

🔹 Set realistic milestones and celebrate progress.

🔹 Avoid get-rich-quick schemes—they often lead to losses.

🔹 Keep learning—read books, listen to financial podcasts, and follow experts.

🔹 Surround yourself with like-minded people who support your financial goals.

Consistency and discipline will pay off in the long run.

Final Thoughts

Financial freedom isn’t about luck—it’s about intentional decisions, smart investing, and disciplined money management.

Start today by setting financial goals, eliminating debt, investing, and creating multiple income streams. The earlier you take action, the sooner you’ll achieve the financial freedom to live life on your own terms.