How AI and Big Data Are Transforming the Insurance Industry

The insurance industry has long been known for its reliance on historical data, complex risk assessments, and meticulous claims processing. However, the rise of artificial intelligence (AI) and big data is revolutionizing how insurers operate, bringing unprecedented efficiency, accuracy, and personalization to the sector.

1. Enhanced Risk Assessment and Underwriting

Traditional underwriting processes involve analyzing historical data, medical records, and questionnaires to assess risk. AI and big data are significantly improving this process by utilizing vast amounts of real-time data from various sources, including wearables, social media, and IoT devices. Advanced machine learning models can now assess risk profiles more accurately, leading to fairer pricing and more customized policy offerings.

2. Improved Fraud Detection and Prevention

Insurance fraud is a major challenge, costing the industry billions of dollars annually. AI-powered fraud detection systems analyze vast datasets to identify patterns and anomalies that may indicate fraudulent activities. Machine learning algorithms can flag suspicious claims, analyze behavioral patterns, and even predict potential fraud before it occurs, reducing losses and enhancing security for insurers and policyholders alike.

3. Faster and More Efficient Claims Processing

Traditionally, claims processing has been a lengthy and labor-intensive task. AI and automation are transforming this process by enabling insurers to assess claims in real time. Natural language processing (NLP) can extract relevant information from claim documents, while computer vision can analyze images of vehicle damage or property loss. As a result, claims can be processed in a fraction of the time, leading to improved customer satisfaction.

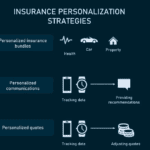

4. Personalized Insurance Policies

With big data analytics, insurers can now offer personalized policies based on individual behaviors and preferences. For example, usage-based insurance (UBI) leverages telematics data to adjust premiums based on driving habits. Similarly, health insurers use wearable device data to provide incentives for maintaining a healthy lifestyle. This level of personalization not only benefits customers with fairer pricing but also helps insurers manage risk more effectively.

5. Predictive Analytics for Risk Mitigation

AI-driven predictive analytics can help insurers identify potential risks before they escalate. By analyzing historical data, market trends, and external factors like climate change, insurers can anticipate future claims and adjust their strategies accordingly. This proactive approach allows insurance companies to minimize losses and offer better coverage options.

6. Chatbots and AI-Powered Customer Support

Customer service is another area where AI is making a significant impact. AI-powered chatbots and virtual assistants can handle routine inquiries, assist with policy management, and guide customers through the claims process. These tools not only enhance customer experience but also reduce operational costs for insurers.

7. Ethical and Regulatory Considerations

Despite the numerous benefits, the use of AI and big data in insurance also raises ethical and regulatory challenges. Insurers must ensure data privacy, prevent algorithmic bias, and comply with evolving regulations. Transparency in AI-driven decisions and maintaining consumer trust will be crucial for the sustainable adoption of these technologies.

Conclusion

AI and big data are reshaping the insurance industry by improving risk assessment, streamlining claims processing, enhancing fraud detection, and offering personalized policies. As technology continues to evolve, insurers that embrace digital transformation will gain a competitive edge, providing smarter, more efficient, and customer-centric services. However, they must also navigate ethical considerations and regulatory requirements to ensure fair and transparent use of AI-driven solutions.

The future of insurance lies in the seamless integration of AI and big data, making the industry more efficient, proactive, and responsive to the needs of modern consumers.