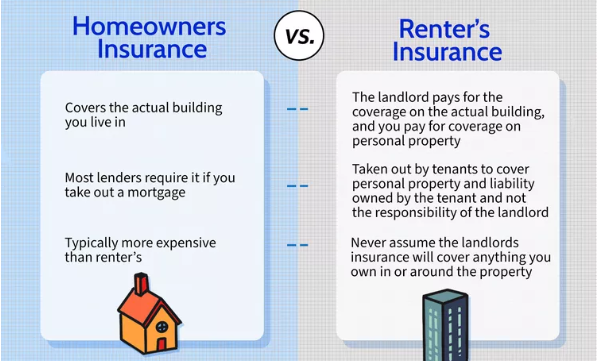

Homeowners Insurance vs. Renters Insurance: What’s the Difference?

When it comes to protecting your home and belongings, two common types of insurance come into play: homeowners insurance and renters insurance. While they share similarities, they serve different purposes and offer different types of coverage. Understanding the key differences can help you determine which type of insurance is right for you.

What is Homeowners Insurance?

Homeowners insurance is a policy designed for individuals who own their homes. This type of insurance covers both the structure of the home and the personal belongings inside it. Homeowners insurance typically includes:

- Dwelling Coverage: Protects the physical structure of your home against damage from events like fire, storms, and vandalism.

- Personal Property Coverage: Covers belongings such as furniture, electronics, and clothing in case of theft or damage.

- Liability Protection: Provides coverage if someone is injured on your property and you are found legally responsible.

- Additional Living Expenses (ALE): Pays for temporary housing and other living expenses if your home becomes uninhabitable due to a covered event.

Homeowners insurance is typically required by mortgage lenders to protect their investment in the property.

What is Renters Insurance?

Renters insurance is for individuals who rent their home, whether it’s an apartment, house, or condo. Unlike homeowners insurance, renters insurance does not cover the physical building itself—only the tenant’s personal property and liability. Key features include:

- Personal Property Coverage: Protects your belongings from perils like fire, theft, and water damage.

- Liability Coverage: Covers legal and medical expenses if someone is injured in your rented home.

- Loss of Use Coverage: Helps pay for temporary living arrangements if your rental unit becomes uninhabitable due to a covered event.

Renters insurance is often required by landlords but is generally much more affordable than homeowners insurance since it does not include dwelling coverage.

Key Differences Between Homeowners and Renters Insurance

| Feature | Homeowners Insurance | Renters Insurance |

|---|---|---|

| Dwelling Coverage | Yes, covers home structure | No, structure is covered by landlord’s insurance |

| Personal Property Coverage | Yes | Yes |

| Liability Protection | Yes | Yes |

| Additional Living Expenses | Yes | Yes |

| Required by Lenders/Landlords | Usually required by mortgage lenders | Often required by landlords |

| Cost | Generally higher due to dwelling coverage | More affordable since it excludes dwelling coverage |

Which One Do You Need?

- If you own a home, homeowners insurance is essential to protect both your property and belongings.

- If you rent, renters insurance provides affordable protection for your possessions and liability without covering the structure itself.

Both types of insurance offer valuable protection against unexpected events. Whether you’re a homeowner or a renter, investing in the right coverage can give you peace of mind knowing your home and belongings are secure.