Hedge Funds and Private Equity: Are They Worth the Hype?

In the world of high finance, hedge funds and private equity (PE) firms are often seen as the pinnacle of investment sophistication. They promise high returns, exclusive access, and a level of financial engineering that is beyond the reach of retail investors. But do they truly live up to the hype, or are they merely vehicles for the ultra-wealthy to move money around?

Understanding Hedge Funds and Private Equity

Before diving into their merits, it’s essential to understand what these investment vehicles are and how they function.

Hedge Funds

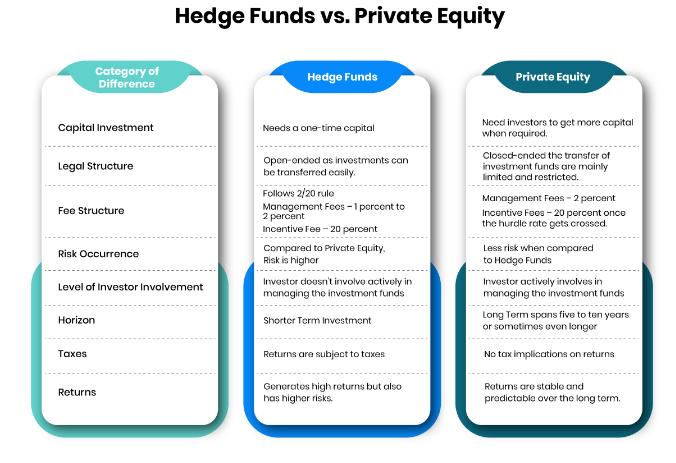

Hedge funds are pooled investment funds that employ a range of strategies to generate high returns for their investors. Unlike traditional mutual funds, hedge funds can invest in a broader array of assets, including stocks, derivatives, currencies, and real estate. They often use leverage (borrowed money) and complex financial instruments to maximize gains. Typically, hedge funds charge a “2 and 20” fee structure—2% of assets under management and 20% of profits.

Private Equity

Private equity firms invest directly in companies, often buying them out, restructuring them, and later selling them for a profit. These firms raise capital from institutional investors and high-net-worth individuals, aiming to increase the value of their portfolio companies through operational improvements and strategic repositioning. Investments in PE are long-term, usually spanning five to ten years before an exit is sought through a sale or an initial public offering (IPO).

The Pros of Hedge Funds and Private Equity

1. Potential for High Returns

Both hedge funds and private equity have historically delivered higher-than-average returns, particularly during market downturns when their active management strategies can mitigate losses.

2. Diversification

Unlike traditional stock and bond investments, these funds often invest in alternative assets, offering investors a way to diversify their portfolios.

3. Access to Exclusive Opportunities

Private equity firms often have access to investment opportunities that are not available to public market investors, such as pre-IPO companies and distressed assets that require significant restructuring.

4. Active Management and Expertise

Hedge fund managers and private equity professionals employ sophisticated strategies, leveraging deep industry knowledge and advanced financial techniques to generate returns.

The Cons of Hedge Funds and Private Equity

1. High Fees

The “2 and 20” fee structure in hedge funds and similar fees in private equity mean that a significant portion of the returns goes to fund managers, potentially diminishing investor profits.

2. Illiquidity

Private equity investments are long-term commitments, often requiring investors to lock in their money for years. Hedge funds, while more liquid, may have lock-up periods restricting withdrawals.

3. High Risk

Both investment vehicles involve a high level of risk. Hedge funds can make aggressive bets that may not always pay off, while private equity firms invest in businesses that may not successfully turn around.

4. Lack of Transparency

Unlike publicly traded assets, hedge funds and private equity firms operate with limited disclosure, making it harder for investors to fully understand where their money is going.

Are They Worth the Hype?

The answer depends on the investor’s risk tolerance, liquidity needs, and financial goals. For ultra-high-net-worth individuals and institutional investors, hedge funds and private equity can be valuable components of a diversified portfolio. However, for the average investor, the high fees, illiquidity, and risks may not justify the potential rewards.

If you are considering investing in these vehicles, thorough due diligence is crucial. Understanding the strategies, risks, and track records of fund managers can make the difference between reaping high rewards and suffering significant losses.

Final Thoughts

Hedge funds and private equity firms remain powerful financial instruments that can yield impressive returns when managed well. However, they are not a one-size-fits-all solution. Investors should weigh the costs, risks, and benefits carefully before jumping on the bandwagon. In finance, as in life, the most hyped opportunities are not always the best ones.