Final Thoughts: How to Create a Personalized Insurance Strategy

When it comes to insurance, a one-size-fits-all approach simply doesn’t work. Every individual and family has unique needs, financial circumstances, and risk tolerances. That’s why creating a personalized insurance strategy is essential for protecting your future while avoiding unnecessary expenses. Here’s how you can develop a tailored plan that fits your life.

1. Assess Your Needs and Risks

The first step in building an effective insurance strategy is evaluating your risks. Consider factors like your age, health status, dependents, income, assets, and liabilities. For example:

- Young professionals may need health insurance, renters insurance, and disability coverage.

- Families may prioritize life insurance and homeowners insurance.

- Retirees might focus on long-term care insurance and estate planning.

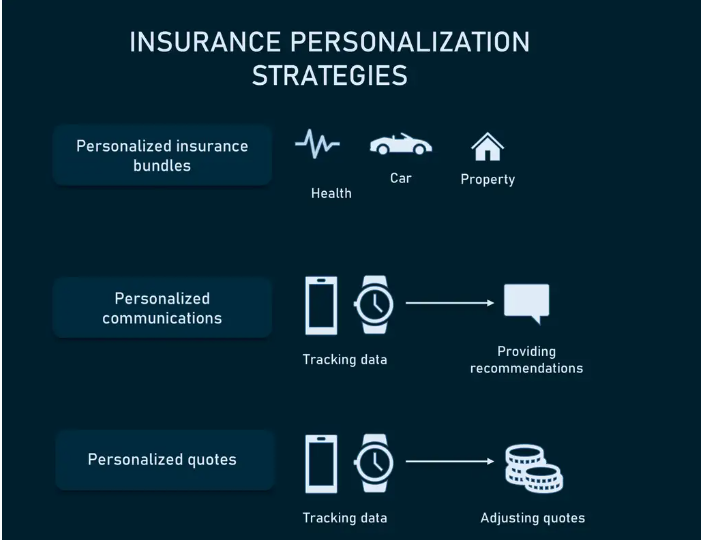

2. Understand the Types of Insurance Available

Knowing what types of insurance exist can help you make informed decisions. Some essential policies include:

- Health Insurance: Covers medical expenses and helps you manage healthcare costs.

- Life Insurance: Provides financial security to your loved ones in case of your untimely passing.

- Auto Insurance: Protects against vehicle damage and liability in accidents.

- Homeowners/Renters Insurance: Covers damages or losses related to your home and personal belongings.

- Disability Insurance: Provides income replacement if you’re unable to work due to illness or injury.

- Liability Insurance: Shields you from lawsuits and financial losses in case of legal claims.

3. Set a Budget and Prioritize Coverage

Your insurance should be comprehensive but also affordable. Assess your financial situation and determine how much you can comfortably allocate to premiums. Prioritize essential coverage first, such as health and life insurance, and then consider additional policies based on your needs and risk profile.

4. Shop Around and Compare Policies

Not all insurance policies are created equal. Research multiple providers, compare coverage options, and read the fine print. Look for:

- Coverage limits and exclusions

- Premium costs and deductible amounts

- Customer reviews and insurer reputation

Using online comparison tools or working with an independent insurance agent can help you find the best policy at the right price.

5. Regularly Review and Adjust Your Coverage

Your insurance strategy needs will evolve over time due to life changes such as marriage, having children, buying a home, or changing jobs. Conduct an annual review of your policies and adjust them as needed to ensure continued protection.

Conclusion

A well-crafted insurance strategy offers peace of mind and financial security. By assessing your risks, understanding different insurance types, setting a budget, comparing options, and reviewing coverage regularly, you can create a plan that truly fits your needs. Investing in the right insurance today means protecting yourself and your loved ones for the future.