Why Diversification Is Key to a Strong Portfolio

When it comes to investing, the age-old saying “Don’t put all your eggs in one basket” couldn’t be more relevant. Diversification is one of the fundamental principles of sound investing, helping to mitigate risk and improve the potential for long-term returns. But why exactly is diversification so crucial, and how can investors apply it effectively to their portfolios?

What Is Diversification?

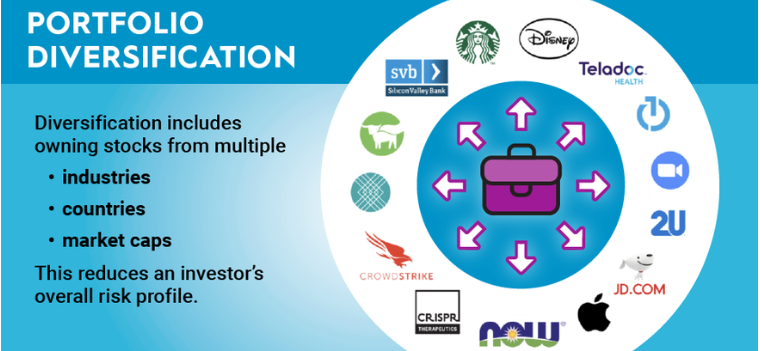

Diversification is the strategy of spreading investments across different asset classes, industries, and geographic regions to reduce exposure to any single risk. By doing so, investors can protect themselves from the volatility of individual securities or market sectors.

Instead of relying on one or two stocks to drive returns, a well-diversified portfolio balances risk across a range of investments, which helps smooth out fluctuations in performance. If one asset underperforms, other assets may offset those losses.

The Benefits of Diversifications

- Risk Reduction – The primary advantage is that it helps manage risk. Different assets react differently to market conditions. While stocks may decline in value during a downturn, bonds or commodities might remain stable or even appreciate. This balance can help prevent drastic losses.

- Smoother Returns – A diversified portfolio is less likely to experience wild swings in value. By holding investments with varied risk levels, you can potentially achieve steadier returns over time, rather than experiencing extreme highs and lows.

- Opportunity for Growth – Exposure to different asset classes increases the potential for capturing growth in multiple areas. If one market sector struggles, others might thrive, ensuring your portfolio remains positioned for positive returns.

- Protection Against Inflation – Some assets, such as real estate or commodities, tend to perform well in inflationary environments. Including these in your portfolio can help safeguard purchasing power when inflation rises.

How to Diversify Your Portfolio

Effective diversification involves spreading investments across various asset types and industries. Here are a few strategies to achieve that:

- Invest in Multiple Asset Classes – Consider holding a mix of stocks, bonds, real estate, commodities, and alternative investments.

- Diversify Within Asset Classes – Within the stock market, for example, invest across different sectors such as technology, healthcare, finance, and consumer goods.

- Geographical Diversification – Markets in different countries and regions behave differently. Investing globally can reduce the impact of local economic downturns.

- Use Index Funds and ETFs – These provide instant diversifications by including a broad selection of assets within a single investment vehicle.