Understanding the Different Types of Credit

Credit plays a crucial role in financial management, allowing individuals and businesses to borrow money and make purchases they might not be able to afford upfront. However, not all credit is the same. Understanding the different types of credit can help you make informed financial decisions and use credit responsibly.

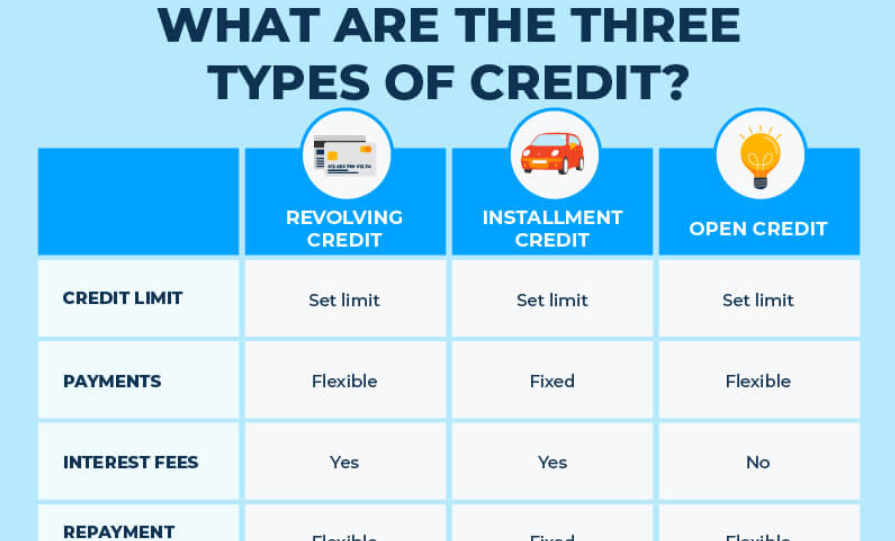

Types of credit:

1. Revolving Credit

Revolving credit allows borrowers to access funds up to a predetermined limit. As you repay what you borrow, the credit becomes available again. The most common example of revolving credit is a credit card.

Characteristics:

- No fixed repayment term

- Interest accrues on unpaid balances

- Minimum monthly payments required

- Can be used repeatedly up to the credit limit

Examples:

- Credit cards

- Home equity lines of credit (HELOCs)

- Store charge cards

2. Installment Credit

Installment credit involves borrowing a set amount of money and repaying it in fixed monthly payments over a specified period. This type of credit is useful for large purchases that require structured repayment plans.

Characteristics:

- Fixed loan amount

- Regular monthly payments

- Set repayment term

- Interest rates may be fixed or variable

Examples:

- Mortgages

- Auto loans

- Student loans

- Personal loans

3. Open Credit

Open credit accounts require full repayment of the borrowed amount by the due date. Unlike revolving credit, these accounts do not carry balances from month to month.

Characteristics:

- Full balance due each billing cycle

- No interest charges if paid on time

- Typically used for services rather than goods

Examples:

- Charge cards (e.g., American Express charge cards)

- Utility bills (electricity, water, gas)

- Cell phone bills

4. Service Credit

Service credit is a form of credit extended by service providers who allow you to use their services before paying for them at a later date.

Characteristics:

- Monthly billing based on usage

- No interest if paid on time

- Late payments can affect credit scores

Examples:

- Utility bills

- Streaming services (e.g., Netflix, Spotify)

- Gym memberships

Why Understanding Types of Credit

Different types of credit impact your credit score and financial well-being in different ways. Properly managing your credit can:

- Improve your credit score

- Help secure better interest rates on loans

- Increase financial flexibility

By understanding and using these different types of credit wisely, you can build a strong financial foundation and maintain a healthy credit profile. Always make payments on time, avoid excessive debt, and monitor your credit report regularly to ensure financial stability.