Understanding Inflation: How It Affects Your Investments

Inflation is an economic concept that affects every aspect of our financial lives, from the cost of groceries to the value of our investments. While it’s often perceived negatively due to rising prices, understanding inflation and its impact on investments can help you make informed financial decisions and safeguard your wealth.

What is Inflation?

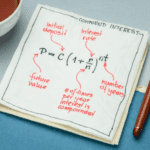

It refers to the general increase in the prices of goods and services over time, leading to a decline in the purchasing power of money. In other words, a dollar today will buy you less in the future if inflation continues. It is typically measured by the Consumer Price Index (CPI) or the Producer Price Index (PPI), which tracks changes in the price levels of goods and services over time.

Inflation has both direct and indirect effects on different types of your investments. Here’s how it impacts Your Investments and various asset classes:

1. Cash and Fixed-Income Investments

Fixed-income investments, such as bonds and savings accounts, are particularly vulnerable to inflation. When inflation rises, the real value of interest payments diminishes, reducing the purchasing power of the income generated. If inflation outpaces the interest rates offered by these investments, investors experience a negative real return.

2. Stocks (Equities)

Stocks generally provide better protection against inflation compared to fixed-income investments. Companies can often pass increased costs onto consumers, preserving their profit margins. However, it can also lead to higher interest rates, which may negatively impact stock valuations, particularly for growth stocks in Your Investments.

3. Real Estate

Real estate is often considered a good hedge against inflation. Property values and rental income tend to rise with inflation, helping investors maintain or increase their wealth. However, rising interest rates (often triggered by inflation) can make borrowing more expensive, which may slow down real estate demand.

4. Commodities and Precious Metals

Commodities, such as oil and agricultural products, often perform well during inflationary periods since their prices typically rise. Gold and other precious metals are also viewed as safe-haven assets, helping investors preserve wealth during high inflation.

How to Protect Your Investments from Inflation

- Diversification: A well-diversified portfolio that includes stocks, real estate, commodities, and inflation-protected securities can help balance risks.

- Investing in Inflation-Protected Securities: Treasury Inflation-Protected Securities (TIPS) are government bonds designed to keep up with inflation, ensuring your purchasing power remains intact.

- Dividend-Paying Stocks: Companies with strong dividend growth can provide a steady income stream that may outpace inflation.

- Real Assets: Investing in tangible assets like real estate, commodities, or infrastructure can help preserve value during inflationary periods.

- Active Portfolio Management: Regularly reviewing and adjusting your investments portfolio in response to economic changes can help maintain your financial stability.