Understanding How Credit Scores Work and the Factors That Influence Them

Your credit score is one of the most important numbers in your financial life. It determines your ability to qualify for loans, credit cards, mortgages, and even rental agreements. A good credit score can open doors to better interest rates and financial opportunities, while a poor score can make borrowing costly and difficult. Understanding how credit scores work and what influences them can help you take control of your financial future.

What is a Credit Scores?

A credit score is a three-digit number that represents your creditworthiness. It is calculated using information from your credit report, which details your borrowing history, repayment habits, and overall financial behavior. Lenders use your credit score to assess the risk of lending money to you.

The most commonly used credit scoring model is the FICO score, which ranges from 300 to 850. Generally, a higher score indicates better creditworthiness, while a lower score suggests a higher risk to lenders.

Factors That Influence Credit Scores

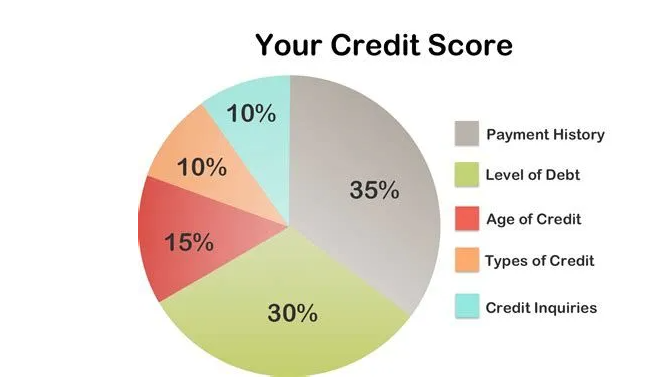

Several key factors contribute to your credit score, each carrying a different weight in the calculation:

1. Payment History (35%)

Your payment history is the most significant factor affecting your credit score. Lenders want to see whether you make payments on time. Late payments, defaults, bankruptcies, and accounts sent to collections can negatively impact your score.

2. Credit Utilization (30%)

Credit utilization refers to the percentage of your total available credit that you are currently using. It is calculated by dividing your total credit card balances by your total credit limits. Keeping your credit utilization below 30% is generally recommended to maintain a healthy credit score.

3. Length of Credit History (15%)

The longer your credit history, the better it is for your score. Lenders prefer to see a track record of responsible credit use over time. This includes the age of your oldest account, the average age of all accounts, and how recently you have used credit.

4. Credit Mix (10%)

Having a diverse mix of credit accounts, such as credit cards, personal loans, auto loans, and mortgages, can positively impact your score. It demonstrates your ability to manage different types of credit responsibly.

5. New Credit Inquiries (10%)

Each time you apply for new credit, a hard inquiry is placed on your credit report. Too many hard inquiries in a short period can lower your score, as it may signal to lenders that you are taking on too much debt.

How to Improve Your Credit Scores

Improving your credit score takes time and effort, but it is achievable by following these strategies:

- Pay Bills on Time: Set up automatic payments or reminders to ensure you never miss a due date.

- Reduce Credit Utilization: Keep your balances low and avoid maxing out your credit cards.

- Maintain Old Accounts: Keeping older accounts open can help improve the length of your credit history.

- Limit New Credit Applications: Only apply for credit when necessary to avoid multiple hard inquiries.

- Monitor Your Credit Report: Regularly check your credit report for errors and dispute any inaccuracies.

Final Thoughts

Your credit scores is a crucial component of your financial well-being. Understanding how it is calculated and taking proactive steps to improve it can save you money and provide better financial opportunities in the long run. By practicing responsible credit habits, you can build and maintain a strong credit score that benefits you for years to come.