Understanding Credit Utilization Ratio: What It Is and Why It Matters

When it comes to maintaining a healthy credit score, many factors come into play. One of the most crucial yet often overlooked factors is the credit utilization ratio. Whether you’re looking to improve your creditworthiness or just better understand how credit works, knowing about credit utilization can be a game changer.

What Is Credit Utilization Ratio?

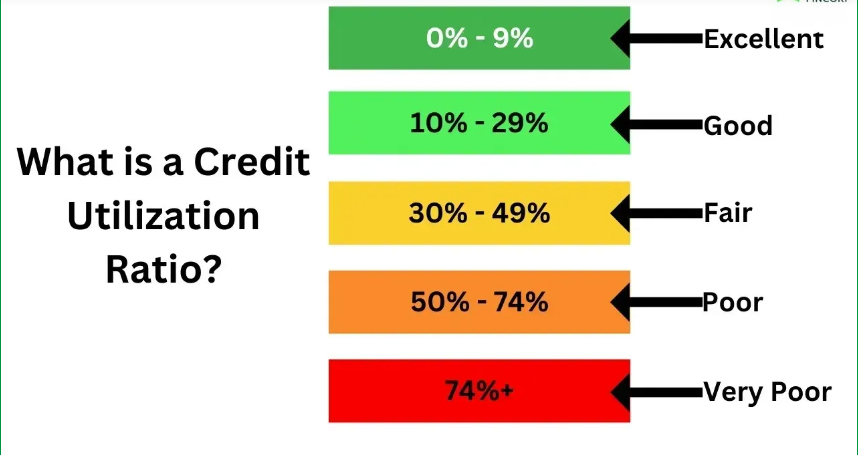

The credit utilization ratio is the percentage of your available credit that you are currently using. It is calculated by dividing your total credit card balances by your total credit limits and multiplying by 100 to get a percentage.

For example, if you have a total credit card limit of $10,000 and your outstanding balances amount to $3,000, your credit utilization ratio would be 30%.

Why Does Credit Utilization Matter?

Credit utilization is a key component of your credit score, typically accounting for about 30% of your FICO score. Here’s why it matters:

1. Impact on Credit Score

A high utilization ratio can negatively affect your credit score, as it signals to lenders that you may be over-reliant on credit. Keeping your utilization low demonstrates responsible credit management and can positively impact your score.

2. Indicator of Financial Health

Credit utilization is often seen as a measure of financial discipline. If you’re consistently maxing out your credit cards, lenders may view you as a riskier borrower. On the other hand, low utilization suggests you are managing credit responsibly.

3. Affecting Loan Approvals & Interest Rates

When you apply for a loan or mortgage, lenders assess your credit utilization ratio to gauge your financial behavior. A high ratio may result in higher interest rates or even loan denials, while a low ratio increases your chances of getting approved with favorable terms.

How to Manage CreditUtilization Effectively

Maintaining a healthy utilization ratio is key to a strong credit profile. Here are some tips:

- Keep utilization below 30%: Ideally, aim for 10%-30% of your total credit limit for optimal credit health.

- Pay balances in full and on time: This not only keeps utilization low but also helps you avoid interest charges.

- Request a credit limit increase: A higher credit limit can lower your utilization ratio if your spending remains the same.

- Spread balances across multiple cards: Instead of maxing out one card, distributing your balances can help maintain a lower ratio.

- Monitor your credit reports: Regularly checking your credit reports helps ensure accurate reporting and allows you to make adjustments as needed.