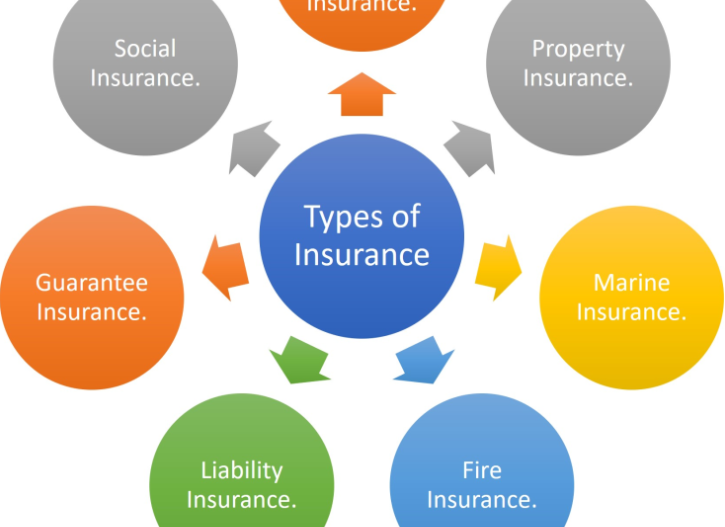

Types of Insurance: A Comprehensive Guide

Insurance plays a crucial role in protecting individuals, families, and businesses from financial hardships. With a wide variety of insurance types available, understanding their benefits and coverage can help you make informed decisions. This comprehensive guide explores the most common types of insurance and how they can safeguard your financial well-being.

Here are Various Types of Insurance

1. Health Insurance

Health insurance covers medical expenses, including doctor visits, hospital stays, prescription drugs, and preventive care. It can be obtained through employers, government programs (such as Medicare or Medicaid), or private providers. Health insurance reduces out-of-pocket costs and ensures access to necessary medical care.

2. Life Insurance

Life insurance provides financial security to beneficiaries in the event of the policyholder’s death. There are two main types of types of insurance:

- Term Life Insurance: Provides coverage for a specific period, such as 10, 20, or 30 years.

- Whole Life Insurance: Offers lifelong coverage with a savings component that accumulates cash value over time.

3. Auto Insurance

Auto insurance protects drivers against financial losses due to accidents, theft, or damage to their vehicles. Common types of coverage include:

- Liability Coverage: Pays for damages and injuries caused to others.

- Collision Coverage: Covers repair costs for your vehicle in an accident.

- Comprehensive Coverage: Covers non-collision damages like theft, vandalism, or natural disasters.

4. Homeowners Insurance

Homeowners insurance provides coverage for damages to a home and its contents due to fire, theft, vandalism, or natural disasters. It also includes liability coverage in case someone is injured on your property. Mortgage lenders typically require homeowners insurance to protect their investment.

5. Renters Insurance

Renters insurance offers coverage for personal belongings and liability protection for tenants. It does not cover the building itself but provides financial assistance in case of theft, fire, or other covered perils.

6. Disability Insurance

Disability insurance replaces a portion of lost income if you become unable to work due to illness or injury. There are two main types:

- Short-Term Disability Insurance: Provides benefits for a few months up to a year.

- Long-Term Disability Insurance: Offers coverage for extended periods, potentially until retirement.

7. Travel Insurance

Travel insurance covers unforeseen expenses during trips, such as medical emergencies, trip cancellations, lost luggage, or flight delays. It is particularly useful for international travelers.

8. Business Insurance

Business insurance helps protect companies from financial losses due to various risks. Common types include:

- General Liability Insurance: Covers lawsuits related to injuries or property damage.

- Property Insurance: Protects business assets like buildings and equipment.

- Workers’ Compensation Insurance: Provides benefits to employees injured on the job.

9. Pet Insurance

Pet insurance covers veterinary expenses for illnesses, accidents, and preventive care. Policies vary based on coverage levels and exclusions.

10. Umbrella Insurance

Umbrella insurance provides extra liability coverage beyond the limits of other policies, such as home or auto insurance. It is useful for individuals with significant assets to protect against major lawsuits.

Conclusion on Types of Insurance

Having the right insurance coverage can provide peace of mind and financial stability in times of unexpected events. By understanding the different types of insurance available, you can choose the policies that best suit your needs and safeguard your future. Always review your options and consult with insurance professionals to ensure adequate protection.