The Role of Credit in Securing a Loan or Mortgage

In today’s financial landscape, credit plays a crucial role in determining an individual’s ability to secure a loan or mortgage. Whether you’re looking to buy a home, finance a car, or start a business, lenders rely heavily on your credit history to assess your reliability as a borrower. Understanding the role of credit in securing a loan can help you prepare for loan applications and improve your chances of approval.

Why Credit Matters to Lenders

Credit serves as a financial report card that provides lenders with insights into your borrowing habits and financial responsibility. When reviewing a loan or mortgage application, lenders evaluate your creditworthiness based on three primary factors:

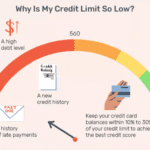

- Credit Score – This is a numerical representation of your credit history, typically ranging from 300 to 850. A higher score indicates responsible financial behavior and lower risk to lenders.

- Credit History – Lenders review the length of your credit history, the types of accounts you have, and your past payment behavior to determine how reliably you manage debt.

- Debt-to-Income Ratio (DTI) – This ratio compares your monthly debt payments to your income. A lower DTI suggests that you have a manageable level of debt and sufficient income to cover new loan obligations.

The Impact of Credit Scores on Loan Terms

Your credit score significantly influences the terms and conditions of your loan or mortgage. A higher score can lead to:

- Lower Interest Rates – Borrowers with excellent credit scores are offered lower interest rates when securing a loan, reducing the total cost of the loan over time.

- Higher Loan Approval Chances – A strong credit profile increases the likelihood of securing a loan, as lenders view you as a trustworthy borrower.

- Better Loan Terms – With good credit, you may receive more favorable loan conditions, such as lower down payments and longer repayment periods.

Conversely, a lower credit score can result in higher interest rates, stricter lending conditions, or even outright loan denial.

Improving Your Credit for Loan Approval

If your credit score needs improvement, consider taking the following steps before applying for a loan or mortgage:

- Pay Bills on Time – Late or missed payments negatively impact your credit score. Set up automatic payments or reminders to ensure timely payments.

- Reduce Debt Levels – Lower your credit card balances and pay off outstanding debts to improve your debt-to-income ratio.

- Monitor Your Credit Report – Regularly check your credit report for errors and dispute any inaccuracies to maintain an accurate credit history.

- Avoid Opening Too Many New Accounts – Each credit inquiry can slightly lower your score. Only apply for new credit when necessary.

Final Thoughts

Your credit score and history play an essential role in securing a loan or mortgage, influencing both approval and the terms you receive. By maintaining good credit habits and proactively improving your score, you can enhance your financial standing and access better borrowing opportunities. Whether you are planning to buy a home or finance a major purchase, a strong credit profile will always work in your favor securing a loan.