The Impact of Late Payments on Your Credit Score

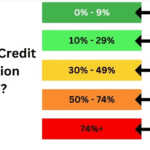

Your credit score is one of the most important financial metrics, influencing everything from loan approvals to interest rates and even job applications. Among the various factors that affect your credit score, payment history holds the most weight—accounting for about 35% of your total score. This means that even a single late payment can have a significant negative impact.

How Late Payments Affect Your Credit Score

When you miss a due date, the consequences aren’t immediate. Most lenders offer a grace period of a few days, but if your payment is 30 days late or more, it will likely be reported to credit bureaus—Experian, Equifax, and TransUnion. The later the payment, the worse the impact:

- 30 Days Late: Your score may drop by 50 to 100 points, depending on your credit history.

- 60 Days Late: The negative impact increases, making lenders wary of your reliability.

- 90+ Days Late: Your account may be sent to collections, further damaging your score and making future credit approvals difficult.

- 120+ Days Late: Your debt may be “charged off,” meaning the lender assumes it won’t be repaid. This is one of the worst marks on a credit report.

Other Consequences of Late Payments

Aside from credit score damage, late payments can lead to additional financial and legal challenges:

- Higher Interest Rates: Late payments signal risk to lenders, which can result in higher interest rates on loans and credit cards.

- Penalty Fees: Credit card companies and lenders charge late fees, increasing the cost of your debt.

- Difficulty Getting Approved for Credit: Future lenders may deny you loans or credit cards based on past late payments.

- Potential Legal Actions: In extreme cases, unpaid debts can lead to lawsuits or wage garnishments.

How to Prevent Late Payments

To avoid late payments and their consequences, consider these proactive strategies:

- Set Up Automatic Payments: Ensure your minimum or full balance is paid on time each month.

- Use Payment Reminders: Schedule alerts on your phone or use budgeting apps.

- Budget Wisely: Plan your expenses to ensure you have funds available for due payments.

- Negotiate with Lenders: If you anticipate a late payment, contact your lender to discuss extensions or hardship programs.

- Monitor Your Credit Report: Regularly check your credit report for errors and ensure payments are reported correctly.

What to Do If You’ve Made a Late Payment

If you’ve already missed a payment, take immediate action:

- Make the Payment ASAP: The sooner you pay, the lesser the damage.

- Call Your Lender: Some creditors may offer a one-time forgiveness for good customers.

- Dispute Errors: If you believe the late payment is incorrect, file a dispute with the credit bureaus.

- Rebuild Your Credit: Maintain on-time payments moving forward and reduce outstanding debt.

Final Thoughts

Late payments can have a long-lasting impact on your financial health, but they are preventable. By being proactive with payments and staying informed, you can protect your credit score and maintain financial stability. If you do experience a late payment, addressing it quickly can help minimize damage and set you on the path to recovery.