Micro-Loans and Alternative Lending Options for Entrepreneurs

Starting and growing a business often requires access to capital, but traditional bank loans can be difficult to secure, especially for small businesses and startups. Fortunately, alternative lending options like micro-loans have emerged as viable solutions for entrepreneurs looking to fund their ventures. In this blog post, we’ll explore what micro-loans are, the benefits they offer, and other alternative lending options available to entrepreneurs.

What Are Micro-Loans?

Micro-loans are small loans, typically ranging from a few hundred to a few thousand dollars, designed to help entrepreneurs, small business owners, and startups access the funding they need. These loans are often provided by nonprofit organizations, government agencies, or online lenders that specialize in supporting small businesses. Unlike traditional bank loans, micro-loans usually have more flexible requirements, making them more accessible to borrowers with limited credit history or collateral.

Benefits of Micro-Loans

- Accessibility – Micro-loans cater to entrepreneurs who may not qualify for traditional bank loans due to poor or limited credit history.

- Lower Borrowing Amounts – Small businesses often don’t need large loans, and micro-loans provide just the right amount to cover initial expenses.

- Flexible Terms – Lenders of micro-loans often offer lower interest rates and more favorable repayment terms.

- Business Development Support – Many micro-lenders provide additional support, such as financial education, mentoring, and networking opportunities.

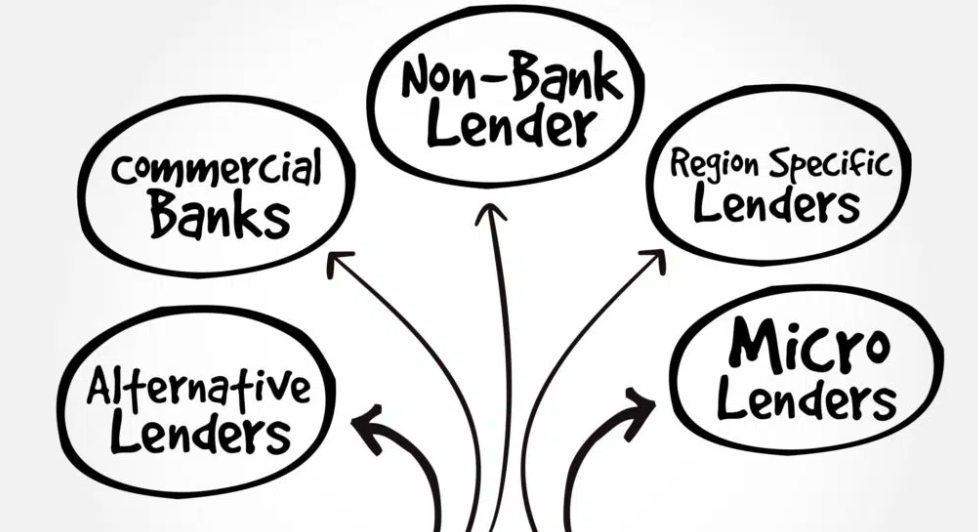

Alternative Lending Options

In addition to micro-loans, there are several alternative lending options available to entrepreneurs, including:

1. Peer-to-Peer (P2P) Lending

P2P lending platforms connect individual investors with borrowers, allowing entrepreneurs to access funds without going through a traditional bank. Platforms like LendingClub and Prosper facilitate these transactions, often with competitive interest rates.

2. Crowdfunding

Crowdfunding allows entrepreneurs to raise small amounts of money from a large number of people through platforms like Kickstarter, Indiegogo, or GoFundMe. This method is particularly useful for businesses with innovative products or strong community support.

3. Invoice Financing

For businesses that generate invoices, invoice financing (also known as accounts receivable financing) allows them to borrow against outstanding invoices. This provides immediate cash flow to cover expenses while waiting for customers to pay their bills.

4. Merchant Cash Advances

A merchant cash advance provides businesses with a lump sum of cash in exchange for a percentage of future sales. This can be a quick way to get funding but often comes with higher fees and repayment costs.

5. Grants and Government Programs

Some entrepreneurs may qualify for grants or government-backed funding programs, such as those offered by the Small Business Administration (SBA) or local economic development agencies.

Choosing the Right Lending Option

When selecting a lending option, entrepreneurs should consider factors such as interest rates, repayment terms, eligibility requirements, and potential risks. Understanding their financial needs and exploring various funding sources can help them make an informed decision.

Final Thoughts

Micro-loans and alternative lending options provide crucial financial support to entrepreneurs who might not have access to traditional bank loans. By leveraging these funding sources, small business owners can overcome financial barriers and take their ventures to the next level. Whether you’re launching a startup or expanding an existing business, exploring these options can help you secure the capital you need to succeed.