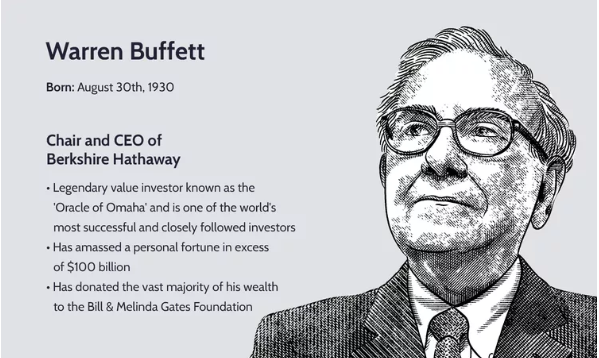

Investment Lessons from Warren Buffett and Other Legendary Investors

When it comes to investing, few names stand out as much as Warren Buffett. Over the decades, Buffett and other legendary investors like Charlie Munger, Peter Lynch, and Benjamin Graham have imparted timeless wisdom that has helped countless investors achieve financial success. Below are some of the most valuable investment lessons we can learn from these greats.

1. Invest for the Long Term

Warren Buffett is famous for his buy-and-hold strategy. He believes that the best investments are those that can be held for decades. His philosophy is simple: “Our favorite holding period is forever.” Instead of chasing short-term gains, focus on businesses with strong fundamentals and competitive advantages that can stand the test of time.

2. Understand What You Invest In

Buffett and his mentor Benjamin Graham emphasized the importance of understanding the businesses you invest in. If you can’t explain how a company makes money, it’s best to stay away. Peter Lynch echoed this sentiment with his mantra, “Invest in what you know.” Investing in industries or companies you are familiar with gives you an edge in assessing their potential.

3. Value Investing: Buy Undervalued Stocks

Benjamin Graham pioneered value investing, a strategy focused on buying stocks that are trading for less than their intrinsic value. Buffett has taken this principle and refined it, favoring companies with strong economic moats, solid management, and consistent earnings growth. The key is to buy great companies at a fair price rather than mediocre companies at a discount.

4. Be Fearful When Others Are Greedy, and Greedy When Others Are Fearful

One of Buffett’s most famous quotes highlights the importance of contrarian investing. Many investors follow the herd, buying when the market is high and selling when fear takes over. Legendary investors like warren buffetttake the opposite approach, seeking opportunities in market downturns when stocks are undervalued.

5. The Power of Compounding

Compounding is one of the most powerful forces in investing. By reinvesting earnings and allowing investments to grow over time, wealth accumulates exponentially. Buffett credits much of his fortune to the magic of compounding, emphasizing that starting early and being patient can lead to massive returns.

6. Avoid Market Timing

Many investors try to predict market movements, but even the best investors acknowledge that timing the market is nearly impossible. Instead of jumping in and out of stocks, it’s better to stay invested and benefit from the market’s long-term upward trajectory.

7. Focus on Quality, Not Hype

Peter Lynch often warned against following market fads and speculative stocks. Instead, he advocated for identifying high-quality companies with strong fundamentals. Investing in companies with sustainable business models and consistent earnings growth is a much more reliable strategy than chasing the latest market trend.

8. Keep Emotions in Check

Emotional investing is one of the biggest pitfalls for investors. Fear and greed drive irrational decisions, leading to poor investment choices. Buffett and Munger emphasize rational thinking and discipline, ensuring that investments are based on fundamentals rather than emotions.

9. Learn Continuously

The best investors are lifelong learners. Buffett famously spends hours each day reading books, financial reports, and newspapers to stay informed. Munger, too, emphasizes the importance of having a broad knowledge base across various fields, as it helps investors make better decisions.

10. Patience and Discipline Pay Off

Legendary investors all share a common trait: patience. Successful investing is not about making quick profits but about sticking to a well-thought-out strategy over time. Avoid the temptation to constantly trade or react to market noise—trust in the process and let your investments grow.

Final Thoughts

The lessons from Warren Buffett and other legendary investors offer invaluable guidance for anyone looking to build long-term wealth. By focusing on fundamentals, investing with discipline, and embracing a long-term perspective, you can improve your chances of financial success. Investing is a marathon, not a sprint—stay patient, stay informed, and stick to sound principles.

What are your favorite investment lessons? Share your thoughts in the comments!