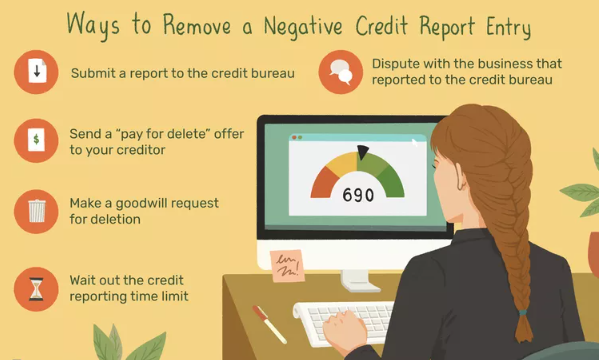

How to Remove Negative Items from Your Credit Report

Your credit report plays a crucial role in determining your financial health. Negative items such as late payments, charge-offs, collections, and bankruptcies can lower your credit score and impact your ability to get loans, credit cards, or even a job. Fortunately, there are steps you can take to remove or minimize the impact of these negative items. Here’s how:

1. Check Your Credit Report

The first step in removing negative items is to review your credit report for errors or outdated information. You can obtain a free credit report from the three major credit bureaus (Experian, Equifax, and TransUnion) once a year through AnnualCreditReport.com.

2. Dispute Inaccurate Items

If you find incorrect or outdated information, you have the right to dispute it with the credit bureau. To dispute an item:

- Gather supporting documents (bank statements, payment confirmations, etc.).

- Submit a dispute online, by mail, or over the phone.

- The credit bureau must investigate and respond within 30 days.

If the information is incorrect, it must be removed or corrected.

3. Request a Goodwill Adjustment

If you have a negative mark that is accurate but was due to an isolated mistake (such as a one-time late payment), you can request a goodwill adjustment from the creditor. This involves writing a polite letter explaining the situation and asking them to remove the negative item as a goodwill gesture.

4. Negotiate a Pay-for-Delete Agreement

If you have outstanding debts in collections, you can try negotiating a pay-for-delete agreement. This means offering to pay the debt (partially or in full) in exchange for the collection agency removing the negative item from your credit report. Not all creditors agree to this, but it’s worth asking.

5. Wait for the Negative Item to Age Off

Most negative items have a limited lifespan on your credit report:

- Late payments: 7 years

- Collections: 7 years

- Charge-offs: 7 years

- Bankruptcies: 7-10 years

- Hard inquiries: 2 years

If you can’t remove an item, focus on building a positive credit history to lessen its impact.

6. Work with a Credit Repair Company

If you feel overwhelmed or unsure how to proceed, you can work with a reputable credit repair company to dispute and remove negative items. However, beware of scams—legitimate companies will never guarantee results or ask for payment upfront.

Final Thoughts

Removing negative items from your credit report takes time and persistence, but it’s possible. Whether through disputing errors, negotiating with creditors, or simply waiting for negative marks to disappear, improving your credit score is within your control. Stay proactive and focus on maintaining good credit habits moving forward.