How to Recover from a Bad Credit Score

Your credit score plays a crucial role in your financial health. A bad credit score can make it difficult to get approved for loans, credit cards, or even rental agreements. However, the good news is that no matter how low your score is, you can take steps to rebuild it. Here’s how you can recover from a bad credit score and get back on track financially.

Ways to Recover From a Bad Credit Score

1. Check Your Credit Report for Errors

One of the first steps in repairing your credit is to obtain a copy of your credit report from major credit bureaus like Equifax, Experian, or TransUnion. Look for any inaccuracies, such as incorrect account balances, missed payments that were made, or fraudulent accounts. If you spot any errors, dispute them immediately with the credit bureau to have them corrected to improve your bad credit score.

2. Pay Your Bills on Time

Your payment history is the most significant factor affecting your credit score. Consistently paying your bills on time, including credit card bills, loans, rent, and utilities, can help improve your credit score over time. Setting up automatic payments or reminders can help ensure you never miss a due date.

3. Reduce Your Credit Utilization Ratio

Credit utilization refers to how much of your available credit you are using. A high utilization rate can negatively impact your score. Try to keep your credit utilization below 30% by paying down balances and not maxing out your credit cards. If possible, make multiple small payments throughout the month to lower your balance.

4. Negotiate with Creditors

If you’re struggling with debt, consider reaching out to your creditors to negotiate better repayment terms. Some creditors may be willing to lower your interest rate, accept a settlement, or establish a payment plan that better suits your financial situation. This can help you avoid late payments and further damage to your credit score.

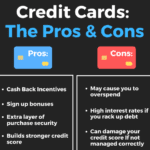

5. Consider a Secured Credit Card

A secured credit card can be a great tool for rebuilding credit. Unlike a traditional credit card, a secured card requires a cash deposit that serves as your credit limit. By making small purchases and paying off the balance in full each month, you can demonstrate responsible credit usage and gradually improve your score.

6. Diversify Your Credit Mix

Having a mix of credit types—such as credit cards, installment loans, and retail accounts—can positively impact your credit score. However, don’t open new accounts just for the sake of it. Only take on new credit if you can manage it responsibly.

7. Be Patient and Persistent

Rebuilding your credit score takes time and consistent effort. Avoid quick-fix schemes or companies that promise to erase negative marks from your report overnight—these are often scams. Instead, focus on responsible financial habits, and over time, your credit score will improve.

Final Thoughts

A bad credit score isn’t permanent, and with the right approach, you can recover and regain financial stability. By checking your credit report, making timely payments, reducing debt, and using credit wisely, you can work your way back to a healthy credit score. The key is to remain patient, disciplined, and proactive in managing your finances.

Have you successfully rebuilt your credit score? Share your experiences and tips in the comments below!