How to Improve Your Credit Score

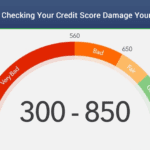

Your credit score plays a crucial role in your financial health. Whether you’re applying for a mortgage, car loan, or even a credit card, lenders use this three-digit number to determine your creditworthiness. A higher credit score can lead to better loan terms, lower interest rates, and greater financial flexibility. If your credit score needs improvement, don’t worry—here are some practical steps to help you boost it over time.

1. Check Your Credit Report Regularly

The first step to improving your credit score is knowing where you stand. Obtain a free credit report from major credit bureaus (Experian, Equifax, and TransUnion) through sites like AnnualCreditReport.com. Review your report for any errors, such as incorrect account information or fraudulent activity. If you find mistakes, dispute them immediately to have them corrected.

2. Pay Your Bills on Time

Payment history is the most significant factor affecting your credit score. Late or missed payments can significantly lower your score. Set up automatic payments or reminders to ensure you never miss a due date. Even making the minimum payment on time can positively impact your score.

3. Reduce Your Credit Utilization Ratio

Your credit utilization ratio is the amount of credit you’re using compared to your total credit limit. Ideally, you should keep this ratio below 30%. If your credit cards are maxed out, work on paying down your balances to reduce your utilization. Consider requesting a credit limit increase to improve this ratio—but be careful not to rack up more debt.

4. Avoid Opening Too Many New Accounts at Once

Each time you apply for credit, a hard inquiry is placed on your credit report, which can temporarily lower your score. Too many inquiries in a short period may signal financial distress to lenders. Instead, space out credit applications and only apply when necessary.

5. Keep Old Accounts Open

The length of your credit history contributes to your score, so avoid closing old accounts unless absolutely necessary. Even if you no longer use a credit card, keeping it open (especially if it has no annual fee) can help maintain a longer credit history and improve your score.

6. Diversify Your Credit Mix

Having a variety of credit types—such as credit cards, installment loans, and mortgages—can positively impact your score. Lenders like to see that you can manage different types of credit responsibly. However, don’t take on unnecessary debt just to diversify your credit mix.

7. Become an Authorized User

If you have a trusted family member or friend with good credit, ask if they can add you as an authorized user on their credit card. This can help you build credit by benefiting from their positive payment history. Ensure the credit card issuer reports authorized user activity to the credit bureaus.

8. Consider a Secured Credit Card or Credit-Builder Loan

If you have a low credit score or no credit history, a secured credit card or credit-builder loan can help establish positive credit habits. With a secured card, you provide a refundable security deposit that serves as your credit limit. Using it responsibly and paying on time can help improve your score over time.

9. Negotiate with Creditors

If you have late payments or high balances, consider reaching out to your creditors. They may be willing to negotiate a lower balance, offer a payment plan, or even remove a late payment from your record. A goodwill letter explaining your situation and requesting a goodwill adjustment can sometimes work in your favor.

10. Be Patient and Consistent

Improving your credit score doesn’t happen overnight. It takes time, consistency, and responsible financial habits. By following these steps and staying disciplined, you’ll gradually see your score improve, unlocking better financial opportunities in the future.

Final Thoughts

A good credit score is essential for financial stability and access to favorable lending terms. By monitoring your credit, making timely payments, managing debt wisely, and avoiding unnecessary inquiries, you can steadily boost your score. Start implementing these strategies today, and over time, you’ll enjoy the benefits of a strong credit profile.