How to Freeze Your Credit to Prevent Fraud

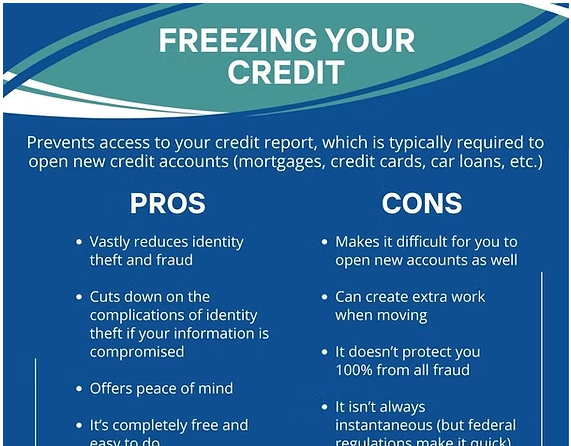

In today’s digital world, identity theft and credit fraud are growing concerns. One of the most effective ways to protect yourself from unauthorized accounts and financial fraud is to freeze your credit. A credit freeze restricts access to your credit report, making it difficult for identity thieves to open new accounts in your name. In this guide, we’ll walk you through everything you need to know about freezing your credit and keeping your personal information safe.

What is a Credit Freeze?

A credit freeze, also known as a security freeze, is a free service that prevents new creditors from accessing your credit report. Since lenders usually check your credit before approving a loan or credit card, freezing your credit makes it harder for fraudsters to open accounts in your name.

Why Should You Freeze Your Credit?

Freezing your credit is a proactive step that helps:

- Prevent identity thieves from opening fraudulent accounts.

- Protect your financial security without affecting your current credit score.

- Provide peace of mind, especially if your personal information has been exposed in a data breach.

How to Freeze Your Credit

You must request a credit freeze from each of the three major credit bureaus: Equifax, Experian, and TransUnion. Here’s how to do it:

Equifax

- Online: Visit www.equifax.com

- Phone: Call 1-800-349-9960

- Mail: Send a written request to Equifax Information Services LLC, P.O. Box 105788, Atlanta, GA 30348

Experian

- Online: Visit www.experian.com

- Phone: Call 1-888-EXPERIAN (1-888-397-3742)

- Mail: Send a written request to Experian, P.O. Box 9554, Allen, TX 75013

TransUnion

- Online: Visit www.transunion.com

- Phone: Call 1-800-916-8800

- Mail: Send a written request to TransUnion, P.O. Box 160, Woodlyn, PA 19094

What Happens After You Freeze Your Credit?

Once your credit is frozen:

- You’ll receive a PIN or password from each bureau to lift or remove the freeze when needed.

- Your credit score remains unaffected.

- You can still use existing credit accounts and apply for jobs, rent an apartment, or purchase insurance.

How to Lift or Unfreeze Your Credit

If you need to apply for new credit, you can temporarily lift the freeze:

- Log in to your account with the credit bureau where you want to unfreeze your report.

- Select the option to temporarily lift the freeze and specify the duration.

- Some lenders may tell you which bureau they use, so you may only need to lift the freeze with one bureau.

Other Ways to Protect Your Credit

- Monitor Your Credit Report: Check your credit reports regularly for suspicious activity.

- Set Up Fraud Alerts: A fraud alert notifies creditors to take extra steps in verifying your identity before opening accounts.

- Use Strong Passwords: Secure your financial accounts with unique, complex passwords.

- Sign Up for Credit Monitoring: Many services provide alerts about potential fraud and changes to your credit report.

Final Thoughts

Freezing your credit is one of the best steps you can take to prevent fraud and identity theft. It’s free, easy to do, and provides long-term protection. By staying proactive, monitoring your credit, and using security measures, you can significantly reduce the risk of financial fraud.

Have you frozen your credit before? Share your experience in the comments below!