How Dollar Cost Averaging Can Reduce Investment Risk

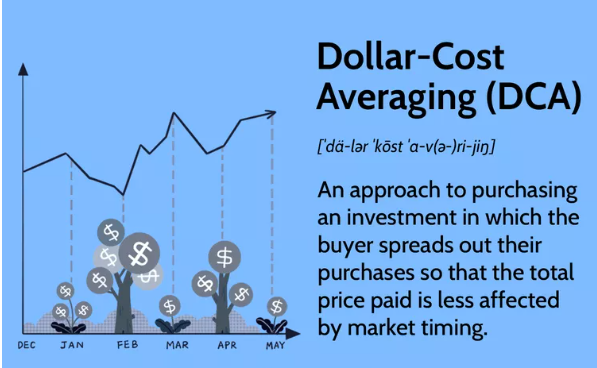

Investing in the financial markets can be intimidating, especially during times of volatility. Many investors worry about buying at the wrong time and suffering losses due to market downturns. One effective strategy to manage this risk is Dollar Cost Averaging (DCA).

Dollar Cost Averaging helps reduce investment risk by spreading out purchases over time, preventing investors from making large lump-sum investments at potentially unfavorable prices. In this blog post, we’ll explore how DCA works, its benefits, and how you can apply it to your investment strategy.

What Is Dollar Cost Averaging (DCA)?

Dollar Cost Averaging (DCA) is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of market conditions. Instead of trying to time the market, you systematically invest over time, buying more shares when prices are low and fewer shares when prices are high.

For example, if you decide to invest $500 per month in a stock or index fund, you will continue doing so consistently, whether the market is up or down. This approach helps smooth out market fluctuations and reduces the impact of short-term volatility.

How DCA Reduces Investment Risk

1. Reduces the Impact of Market Volatility

Markets fluctuate daily, making it difficult to predict the best time to invest. By investing at regular intervals, DCA helps mitigate the risk of making a large investment right before a market drop.

-

When prices are high, your fixed investment buys fewer shares.

-

When prices are low, your fixed investment buys more shares.

Over time, this strategy lowers the average cost per share, reducing the risk of making a poor investment decision.

2. Eliminates Emotional Investing

Fear and greed often drive investors to make impulsive decisions, such as panic selling during downturns or chasing market highs. DCA removes emotional decision-making by enforcing a consistent and disciplined approach to investing.

-

No more worrying about market timing.

-

No emotional reactions to short-term market movements.

-

A structured investment approach that aligns with long-term goals.

3. Encourages Long-Term Investing

Dollar Cost Averaging aligns with a long-term investment strategy, helping investors focus on gradual wealth accumulation rather than short-term market movements.

-

Investing consistently over months or years takes advantage of compound growth.

-

Helps investors stay invested during both market highs and lows.

-

Builds discipline by reinforcing regular investing habits.

4. Makes Investing More Accessible

DCA is particularly beneficial for investors with limited capital because it allows them to invest gradually rather than waiting to accumulate a large lump sum. This makes it easier for beginners to start investing without needing a significant initial amount.

Example of Dollar Cost Averaging in Action

Let’s assume you decide to invest $500 per month into an index fund over six months:

| Month | Stock Price | Shares Purchased |

|---|---|---|

| January | $50 | 10.00 |

| February | $40 | 12.50 |

| March | $45 | 11.11 |

| April | $38 | 13.16 |

| May | $42 | 11.90 |

| June | $48 | 10.42 |

-

Total Invested: $3,000

-

Total Shares Purchased: 69.09

-

Average Cost Per Share: $43.40

By spreading out the investment over time, the average cost per share ($43.40) is lower than the highest stock price during the period ($50). This demonstrates how DCA helps lower investment risk.

When to Use Dollar Cost Averaging

DCA works best when:

✅ Investing in long-term assets like index funds, ETFs, or blue-chip stocks.

✅ Facing market uncertainty or volatility where prices fluctuate significantly.

✅ You don’t have a large lump sum to invest but want to start building wealth.

However, if the market is in a prolonged uptrend, a lump-sum investment may generate higher returns since prices continue to rise.

Final Thoughts

Dollar Cost Averaging is a powerful strategy that helps investors reduce risk, manage emotions, and stay consistent in their investment approach. While it may not maximize short-term gains, it provides long-term stability and helps navigate market fluctuations with confidence.

By implementing DCA, investors can take advantage of gradual wealth accumulation, ensuring they don’t fall victim to market timing mistakes.