FHA, VA, and Conventional Loans: Which One Should You Choose?

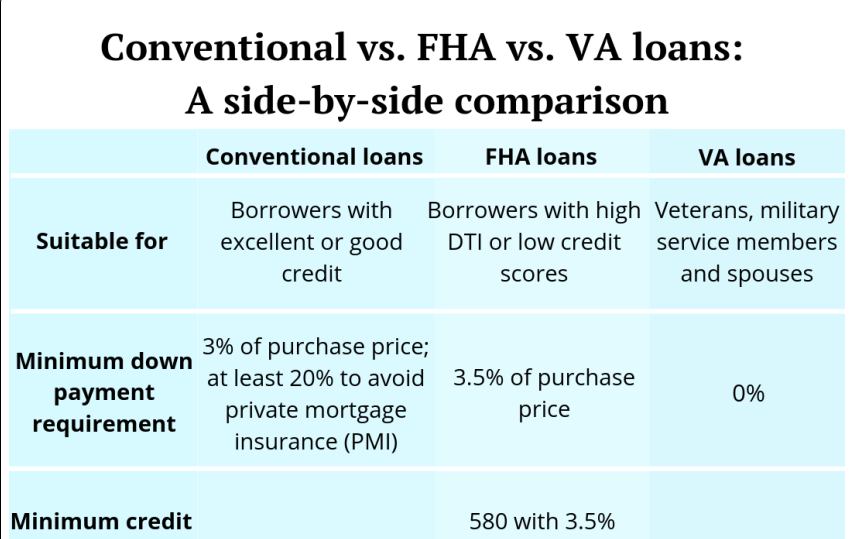

When buying a home, choosing the right type of mortgage loan is crucial. Three of the most common loan options are FHA loans, VA loans, and conventional loans. Each has unique benefits and requirements, making one option better suited for certain buyers than others. In this post, we’ll break down these loan types to help you determine which one best fits your financial situation and homeownership goals.

FHA Loans: Ideal for First-Time Buyers

FHA (Federal Housing Administration) loans are government-backed mortgages designed to help buyers with lower credit scores and smaller down payments.

Pros:

- Lower Credit Score Requirements: FHA loans allow credit scores as low as 580 with a 3.5% down payment or as low as 500 with a 10% down payment.

- Smaller Down Payment: Requires only 3.5% down, making it a great option for first-time homebuyers or those with limited savings.

- Flexible Debt-to-Income Ratios: FHA loans are more lenient when it comes to debt-to-income (DTI) ratios compared to conventional loans.

Cons:

- Mortgage Insurance Premium (MIP): FHA loans require an upfront mortgage insurance premium and ongoing monthly mortgage insurance, which can add to the cost.

- Loan Limits: FHA loan limits vary by location and may not be enough for high-cost areas.

- Property Restrictions: The home must meet FHA standards, which could limit your options.

VA Loans: Best for Eligible Veterans and Service Members

VA (Veterans Affairs) loans are available to eligible veterans, active-duty service members, and certain military spouses. These loans are backed by the U.S. Department of Veterans Affairs.

Pros:

- No Down Payment Required: VA loans allow 100% financing, making homeownership more accessible.

- No Private Mortgage Insurance (PMI): Unlike FHA and conventional loans, VA loans do not require PMI, reducing monthly payments.

- Competitive Interest Rates: VA loans typically have lower interest rates than conventional or FHA loans.

- Flexible Credit Requirements: VA loans offer lenient credit score requirements compared to conventional loans.

Cons:

- Funding Fee: While there’s no PMI, VA loans require a one-time funding fee, which can be rolled into the loan.

- Eligibility Restrictions: Only available to veterans, active-duty members, and qualifying spouses.

- Property Restrictions: VA loans require the home to meet specific standards, similar to FHA loans.

Conventional Loans: Best for Borrowers with Strong Credit

Conventional loans are not backed by the government and are ideal for borrowers with strong credit and stable finances.

Pros:

- No Mortgage Insurance with 20% Down: If you put down at least 20%, you won’t need PMI, which lowers monthly costs.

- Higher Loan Limits: Conventional loans allow for higher loan amounts, making them ideal for expensive markets.

- More Property Flexibility: Unlike FHA and VA loans, there are fewer restrictions on property condition and type.

- Competitive Interest Rates: With good credit, you may qualify for lower interest rates than FHA loans.

Cons:

- Higher Credit Score Requirements: Generally, a credit score of at least 620 is needed, though higher scores get better rates.

- Larger Down Payment: Requires a minimum of 3% down, but a higher down payment is typically recommended.

- Stricter Debt-to-Income Ratio Requirements: Lenders may have tighter DTI ratio restrictions compared to FHA or VA loans.

Which Loan Should You Choose?

- Choose an FHA loan if you have a lower credit score, a smaller down payment, or are a first-time homebuyer.

- Choose a VA loan if you are an eligible veteran or active service member and want a loan with no down payment and no PMI.

- Choose a conventional loan if you have good credit, a stable income, and want to avoid mortgage insurance by putting down at least 20%.

Each loan type has its advantages and drawbacks, so it’s important to assess your financial situation, credit score, and long-term homeownership plans before making a decision. Speaking with a mortgage lender can help you compare your options and choose the best loan for your needs.

Final Thoughts

The right mortgage can make homeownership more affordable and aligned with your financial goals. Whether you go with an FHA, VA, or conventional loan, understanding the key differences will help you make an informed decision. Do your research, compare rates, and work with a trusted lender to secure the best deal possible!

Need Help Choosing the Right Loan? Reach out to a mortgage professional today to discuss your options!