Does Checking Your Credit Score Hurt It?

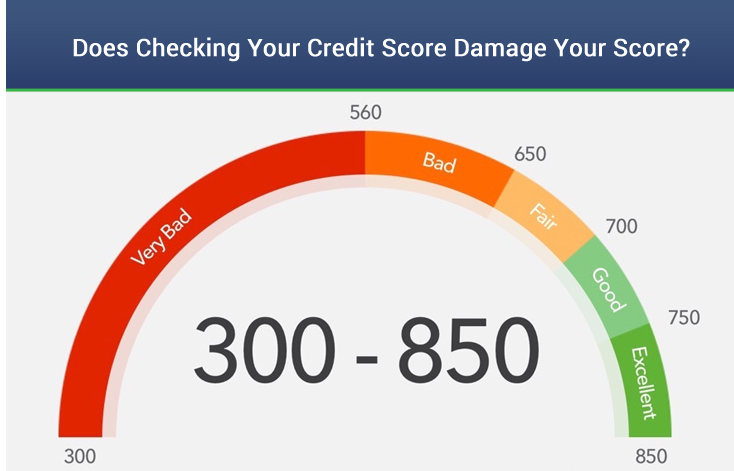

Your credit score plays a crucial role in your financial life, affecting everything from loan approvals to interest rates and even rental applications. But if you’re actively monitoring your credit, you may have wondered: “Does checking my credit score hurt it?” The short answer is no—but with some important distinctions. Let’s break it down.

Hard Inquiries vs. Soft Inquiries

When it comes to checking your credit, not all inquiries are created equal. There are two main types:

- Soft Inquiries (or Soft Pulls)

- A soft inquiry happens when you check your own credit grade or when a lender pre-approves you for an offer.

- These inquiries do not impact your credit grade.

- Examples include checking your grade through free credit monitoring services, employer background checks, or pre-qualified credit card offers.

- Hard Inquiries (or Hard Pulls)

- A hard inquiry occurs when a lender or creditor reviews your credit report as part of a lending decision.

- These inquiries can affect your credit score, but typically only by a few points.

- Examples include applying for a mortgage, car loan, or credit card.

Why Hard Inquiries Affect Your Credit Score

Credit scoring models like FICO and VantageScore take hard inquiries into account because they indicate that you’re actively seeking new credit. If you accumulate multiple hard inquiries in a short period, lenders may see this as a red flag, suggesting that you could be experiencing financial distress.

However, hard inquiries generally have a small and temporary impact on your credit score. They usually lower your score by about 5 points or less and stay on your report for two years, though their impact diminishes after a few months.

The Exception: Rate Shopping for Loans

If you’re shopping around for the best mortgage, auto loan, or student loan rates, credit scoring models recognize this and typically treat multiple inquiries within a short period (usually 14 to 45 days) as a single inquiry. This means you won’t be penalized for comparing rates from different lenders.

Best Practices for Checking Your Credit

- Monitor Your Credit Regularly: Use free credit monitoring services or request your free annual credit report from AnnualCreditReport.com to stay informed.

- Limit Hard Inquiries: Only apply for credit when necessary, and avoid multiple applications in a short period unless you’re rate shopping.

- Improve Your Credit Health: Focus on paying bills on time, keeping credit utilization low, and maintaining a mix of credit accounts to strengthen your score over time.

Final Thoughts

Checking your own credit score will not hurt your credit, so you can (and should) monitor it regularly. However, applying for new credit may result in a hard inquiry, which can cause a small dip in your score. Understanding the difference between soft and hard inquiries empowers you to take control of your financial health while minimizing any negative impact.

By staying informed and making strategic financial decisions, you can keep your credit score strong and achieve your financial goals with confidence.